17pc tax on number of items proposed; Shaukat Tarin dismisses inflation fears

• Govt withdraws Rs343bn sales tax exemptions

• Finance minister says sales tax on machinery and pharma adjustable, refundable

• Terms SBP autonomy essential for overall growth of economy

• Tax exemption retained on basic food items

• Bill proposes advance income tax on screening of foreign TV drama serials

• Tax on transfer of newly purchased vehicles increased to discourage own-money

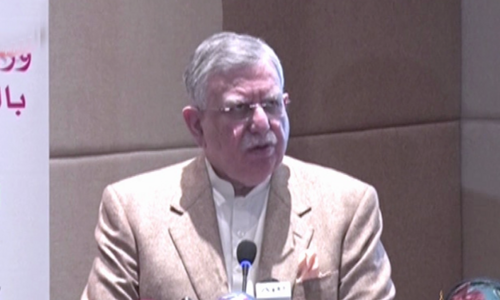

ISLAMABAD: Finance Minister Shaukat Tarin presented in the National Assembly on Thursday the Finance (Supplementary) Bill 2021 envisaging withdrawal of sales tax exemptions worth Rs343 billion on machinery, pharma and imported food items.

The bill also proposes an increase in rates of federal excise duty, income tax and sales tax on services in the federal capital territory.

Mr Tarin explained that sales tax on machinery and pharma sector is adjustable and refundable. He said the levy of 17 per cent sales tax on several hundred items, which would directly or indirectly affect the people, would raise around Rs71bn for the national kitty.

The withdrawal of tax exemptions includes Rs31bn on luxury goods and Rs31bn on business goods.

“Elites, not the common man, are beneficiary of these exemptions,” Mr Tarin said, adding that tax exemptions of Rs343bn had been benefiting various interest groups for the past 70 years. “We have targeted only those items which are used by the elites.”

However, Mr Tarin said the levy of 17pc sales tax on some specific items would raise Rs2bn, adding that the tax on these items would only affect the ordinary people. “We have only increased the cost of imported luxury items,” he said, adding that local supply of most items remained unchanged.

The minister explained that withdrawal of tax exemptions worth Rs112bn on machinery and Rs160bn on pharmaceutical sector is adjustable and refundable. He did not consider these as taxes which will now be collected at the rate of 17pc on import of machinery and from the pharma sector.

The bill proposes 17pc sales tax on a number of items which were earlier exempted from the tax. The government terms these products luxury items which include import of live animals, steak meat, fish, vegetables, high-end bakery items, branded cheese, imported sausages, high-end cellphones and import bicycles.

At the same time, a number of items is proposed in the bill for targeted subsidy to minimise the impact of 17pc sales tax. These include oilcake, animal feed, poultry feed, maize seed (for corn oil) and cottonseed (for oil mills). Other items that will now attract 17pc tax on import are magazines and fashion journals.

The targeted subsidy plan of Rs33bn has been proposed to protect any segment of population which may get affected even indirectly by the withdrawal of some exemptions, etc.

According to finance minister, the 17pc sales tax imposed on the items used by common people would yield only Rs2bn for the government. These items include personal computers, sewing machines, match boxes, iodised salt, red chili and contraceptives.

Tax exemption is retained on basic food items — import and supply of rice, wheat, meslin, and local supply of other grains. Exemptions continue on local supply of fruits, vegetables, beef, mutton, poultry, fish, eggs, sugarcane and beet sugar. Similarly, zero rating on milk and fat-filled milk is also retained.

The exemptions on vegetables and fruits from Afghanistan is also maintained. Education text books, stationary items and locally manufactured laptops and personal computers will remain exempted from sales tax.

In the agriculture sector, the reduced rate of 2pc on fertiliser at out-stage will continue, along with multiple reduced rates on fertiliser inputs as currently available. The sales tax exemption will continue on pesticide and tractors will continue to be sold at 5pc tax rate.

Federal excise duty on imported and locally manufactured/assembled vehicles is proposed to be increased on the recommendations of the Tariff Policy Board and the Ministry of Commerce. Advance tax on cellular services is proposed to be increased from 10pc to 15pc, while withholding tax is proposed on foreign produced TV serial/dramas and advertisements with foreign actors.

Tax on transfer of newly purchased vehicles has been increased to discourage the practice of own-money. Exemptions available to REIT have been extended to special purpose vehicles set up under a REIT.

Pharmaceutical firms have been equated with exporters for purposes of release of refunds within 72 hours. Therefore, pharma firms will now be able to claim refunds on GST paid as input tax on packaging material, utilities, etc., which they previously could not — having price tag of Rs35bn.

Expectedly, the prices of medicines in the retail market should come down, approximately by 20pc.

The finance minister in a briefing to the media said those crating a hue and cry over the supplementary finance bill and the State Bank Pakistan (SBP) autonomy bill were only politicising the technical matter without any rationale. He also highlighted the importance of the SBP autonomy and said it was essential for the overall growth of country’s economy.

The minister said the allegations being levelled against the government were baseless because not every suggestion of the IMF had been accepted in the SBP autonomy bill. “We need to understand that all those countries, which have not granted independence to their central banks, like Turkey, have suffered.”

Mr Tarin clarified that there were no constitutional amendments in the SBP autonomy bill and it had been approved with a simple majority only. “If we feel that the State Bank is getting out of hand, a simple majority is required to finish these amendments.”

He said the main purpose of granting autonomy to the State Bank was to end government borrowings and claimed that the incumbent government had not borrowed anything from the central bank over the past two-and-a-half years. “Besides, there will be an SBP board appointed by the government to make key decisions, while the State Bank will be answerable to the standing committees of parliament, too,” the minister said.

Published in Dawn, December 31st, 2021