KARACHI: As expected the surprise rally on Thursday that saw the KSE-100 index storm past the 48,000 points to record gains of massive 805 points was merely a one-off event, triggered by a ‘state-owned pension fund’ that poured $12.8m in the market through the mutual funds.

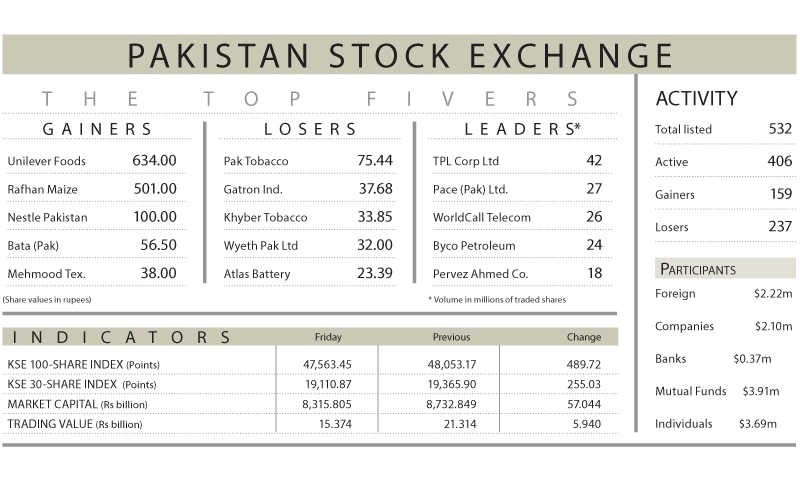

On Friday the market returned to the bearish trajectory with selling pressure seen throughout the day. The index lost 490 points, or 1.02 per cent, and settled for the weekend at 47,563. In the four bearish sessions during the week, the index lost 123 points.

Investors had reason to flee on Friday as they woke up to the warnings by National Command and Operations Centre (NCOC) chief Asad Umar that “there were clear signs of a fourth wave of Covid-19 starting in the country due to poor compliance to SOPs and arrival of the Indian variant”. He also said that the indoor facilities could be shut down if SOPs were violated.

Investors feared that could be a prelude to smart or complete lockdowns. All this came on top of the prime minister’s statement a day earlier that the fourth wave of novel coronavirus could hit the country, urging people to follow precautionary measures to avoid lockdown.

The trading volume increased 7pc over the previous day to 506m shares. Volume leaders were TPL, PACE and WTL churning 95m shares out of the total market volume. The traded value decreased to $97m from $134m during the previous session. The index succumbed to selling pressure mainly from TRG, LUCK, KAPCO, HUBC and PAKT, as they cumulatively pulled down the index by 214 points.

Other reasons for the investors’ disinterest in equities was due to the political uncertainty in and around the country. Volatility in international oil prices which is thought to be a key risk for the current account position and the upcoming financial results for the quarter ended Dec 31, 2021.

Published in Dawn, July 10th, 2021

Dear visitor, the comments section is undergoing an overhaul and will return soon.