Most conversations about exports from Pakistan focus on one industry alone: textiles. This is perhaps only natural. After all, textiles make up around 60 percent of the country’s overall exports.

The (relative) good news is that the sector is currently running at its optimum level. But, unfortunately, the reason behind this upsurge is the havoc wreaked by the coronavirus. Global suppliers have diverted orders to Pakistan, in large part because of the pandemic’s devastating impact on India and Bangladesh.

The further bad news is that the upsurge may be temporary. And once things normalise, Pakistan’s economy, which continues to rely heavily on the textile sector, may feel the impact.

This over-reliance on textiles is hardly a new phenomenon. The government regularly gives the sector subsidies on the import of machinery and raw materials. And in Pakistan’s 73-year-long history, the industry has been given numerous bailout packages in order to be revived.

Many have recognised the problems with relying on one sector in this way.

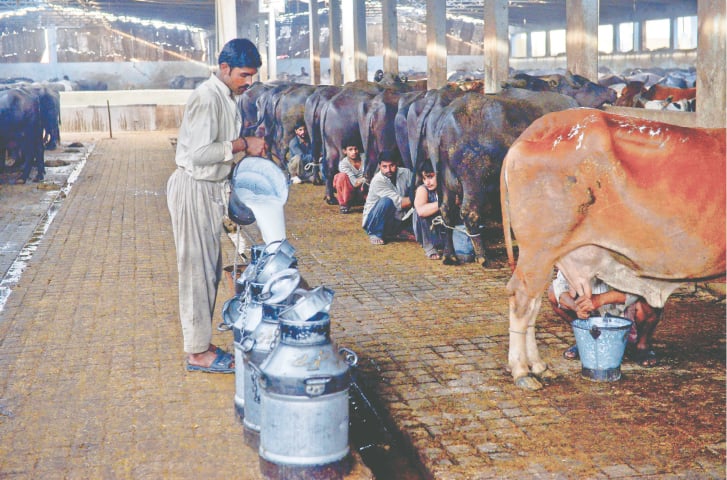

Pakistan is the fourth largest milk producer in the world. But it lags far behind in global exports of dairy products. If certain infrastructural issues can be addressed, it could be earning up to 30 billion US dollars. So what’s stopping it?

Speaking at a Karachi Chamber of Commerce and Industry webinar in December, Adviser to the Prime Minister on Institutional Reforms Dr Ishrat Husain stressed the importance of looking beyond the textile sector and diversifying Pakistan’s exports. Otherwise, he warned, we will remain “stuck” at 25 to 30 billion dollars in exports per year.

“If we can capture just one percent of the Chinese market by providing components, raw materials [and] intermediate goods to the Chinese supply chain,” he had said, “we can get 23 billion dollars in exports to China, which is very favourably inclined towards Pakistan...”

From the looks of it, others were on the same page as Husain. Last month, it was reported by China Economic Net (CEN) that China will import dairy products from Pakistan. The Commercial Counsellor at the Pakistan Embassy in Beijing, Badar uz Zaman, told CEN that Pakistan got this opportunity due to its high quality dairy products, available at a low price.

Pakistan is the fourth largest milk producer globally, Zaman pointed out.

Indeed, the country’s dairy industry has great potential and can prove to be ‘white gold’ for Pakistan. Unfortunately, the sector is currently struggling due to various reasons but, if its export potential is realised, it can transform not only the sector itself but Pakistan’s economy as well.

WASTED POTENTIAL

According to the Food and Agriculture Organisation at the United Nations, in the last three decades, global milk production has increased by more than 59 percent, from 530 million tonnes in 1998 to 843 million tonnes in 2018.

This rise in global milk consumption is an opportunity for countries such as Pakistan to earn foreign exchange by exporting milk and dairy products to countries which have insufficient milk production. According to a Pakistan Dairy Association estimate, with support from the government, Pakistan can earn up to 30 billion dollars from exports of only dairy products and milk.

Unfortunately, this potential is being wasted. As per statistics provided by the Pakistan Dairy Association, livestock and dairy currently make up approximately only 3.1 percent of Pakistan’s total exports; which would mean about a mere 0.68 billion dollars in FY2020.

There are multiple reasons for this.

The issues start right at the source. Our farmers are unaware of methods they can employ to take better care of their animals and this impacts their milk yield and quality of produce. Farmers often do not (or are unable to) provide nutritious feed to the animals and many also fail to get them vaccinated on time. Besides, in the absence of qualified veterinarian doctors, unqualified quacks prescribe incorrect medicines to animals and compound the misery of dairy farmers.

In many dairy farms, especially those located close to urban centres, farmers resort to unhealthy methods to increase milk production. For years now, farmers have been misusing oxytocin injections, which include hormones intended for women in labour, to increase the production of milk in animals.

This is bad not only for the cattle but also for the people who will consume the milk and, ultimately, it is bad for business. According to a 2019 MSF (Doctors Without Borders) report on the health risks to mothers and newborns because of the misuse of labour-inducing drugs, in Pakistan, “oxytocin is available in many pharmacies without prescription for a mere few cents…”

The lack of education in farmers is only part of the problem. Indeed, some companies that sell packaged dairy products work closely with farmers living in rural and suburban areas. These companies have enabled farmers to provide their animals with a more nutritious feed, and also support them in getting the animals vaccinated. But these efforts can only go so far.

Unfortunately, a large quantity of milk is still lost due to a lack of proper storage facilities with the farmers and due to other factors, such as the unavailability of roads and a proper infrastructure to transfer this milk to the urban centres.

LOW YIELD ANIMALS AND LOOSE MILK

Another major barrier is that most farmers in Pakistan have low yield animals. Even though the country has more milk-producing animals than the US, its milk production is far lower.

In Pakistan, the average milk yield of a cow is 14 litres per day, while buffalos can produce 10 litres daily. While cows are the preferred animal globally to produce milk, buffaloes are the preferred choice in Pakistan. Buffalo milk is liked more, by customers and farmers alike, due to its high fat content, thickness and delicious taste.

According to the Economic Survey of Pakistan, in 2019-20, the gross milk production of Pakistan was 61,690 thousand tonnes (nearly 62 billion litres). Cows produced 22,508 thousand tonnes, while buffaloes produced 37,256 thousand tonnes. The rest was produced by sheep (41 thousand tonnes of milk), goats (965 thousand tonnes) and camels (920 thousand).

Milk available for human consumption was nearly 50,000 thousand tonnes (18,007 thousand tonnes from cows, 29,805 thousand from buffaloes, 41,000 from sheep, 965,000 from goats and 920,000 from camels). This average was calculated by subtracting 20 percent wastage — 15 percent due to faulty transportation and a lack of chilling facilities, and five percent in suckling calf nourishment).

Another factor, according Rafiq, a dairy farmer in Karachi’s Malir area, is that because buffalo milk is thicker, it is easier to mix water in it — a common practice among sellers of loose milk.

In Pakistan, more than 90 percent of the population still relies on untreated loose milk. Due to a lack of proper cold chains during supply, this loose milk often gets contaminated and becomes unhealthy for human consumption.

Milk is a highly perishable item, but packed in proper foil-lined cartons, it can survive on a shopkeeper’s shelf for up to three months. Packaged milk remains out of reach for a majority of Pakistanis for various reasons, however.

Hussain Raza Khan, the marketing director of Tetra Pak Pakistan, tells Eos that, while Pakistan has great potential to export value-added products made from milk, to achieve this goal, “we have to put our house in order first.” Khan estimates that over 80 percent of the milk produced in Pakistan is produced by small dairy farmers who have no more than one to four milk-producing animals. He believes that the government has to work to improve the lives of these dairy farmers, and only then can the sector transform.

Khan adds that, because of faults in the milk distribution mechanism, companies producing packaged milk are working at only 40 percent capacity. He estimates that if these companies worked at even 60 percent capacity, the price of packaged milk could be reduced by 10 to 15 rupees per kilogramme — a decrease that would surely widen the pool of people who can afford to buy packaged milk.

FOCUSING ON DAIRY PRODUCTS

“Cheese is milk’s leap towards immortality,” Clifton Fadiman, an American author and television personality, once said.

Milk, at the end of the day, has a short shelf life. And while exporting milk is possible (and can be highly lucrative), a better option, according to many industry insiders, would be to focus on exporting value added products such as cheese, butter and desi ghee. Not only do these products last longer — an important consideration when talking exports — they are also used regularly during the preparation of various foods.

But, even though a considerable amount of milk is produced in South Asia (25 percent of all the milk produced around the world), the region has made little contribution towards the global exports of dairy products. By taking initiative in this regard, Pakistan can play a leadership role in the region.

The country has the potential to export cheese and other products made from milk but, because of a lack of planning, we are spending precious foreign exchange on importing these products that can be easily produced locally.

Initiatives such as setting up cottage industries would not only empower these farmers, it would also help ease the burden on Pakistan’s already overcrowded urban centres. As we have seen around the globe, these small industries can be revolutionary and can maximise production.

It’s not just cheese that is being imported. Even though we produce a surplus of milk in Pakistan, the country still ends up spending 20 billion rupees every year to import milk and other dairy products.

Zawar Abbasi, a dairy farmer from Bahawalpur, tells Eos that approximately 40 kilogrammes of milk are required to produce five to six kilogrammes of cheese. A similar quantity of milk can produce three kilogrammes of butter, which can further be converted to about 1.5 kilogrammes of desi ghee.

Abbasi produces all of the above in a big utensil placed in his small kitchen. These materials are then used in a sweet shop he owns in Multan. While Abbasi’s is a small operation, Pakistan is perfectly situated to become a big exporter of cheese. Luckily for the country, 67 percent of global cheese exports are to only 15 countries around the world, including Russia and China. Not only has Pakistan maintained good relations with its ‘all-weather friend’ China for decades, the country’s ties with Russia are also improving. Surely, these can be leveraged to yield profits.

By entering the field of manufacturing cheese, butter and ghee commercially, Pakistan can not only tap the market of these two countries, but can also enter the huge market in central Asia and in the Gulf.

The worldwide consumption of milk’s by-products including cheese, butter and ghee, is increasing. At the moment, there are relatively fewer players and Pakistan can capture a large chunk of this market by entering it in the near future.

Also, within Pakistan, with the rising popularity of international food chains and fast food, the consumption of cheese has increased manifold. By producing quality, low-priced cheese locally, the country can cater to this demand as well.

The Pakistan Dairy Association’s Dr Amin says that there are many cheese-producing plants in the country, including Adam’s Milk Foods (Adam’s), Fauji Foods (Nurpur), Sapphire Dairies (Rivayat Farms) and Achha Foods (Achha). Other than these larger operations, small cheese producers exist as well.

LEARNING FROM GLOBAL BEST PRACTICES

Pakistan’s government can learn from the best practices applied in the dairy sector by countries around the world. New Zealand has a programme called ‘The Dairy Tomorrow Strategy’, which is focussed on the key challenges and opportunities that face the dairy sector. The focus is on animal care, nurturing the environment and community-building. They have designed these strategies with input from across the dairy sector, and make the farmers a real part of the conversation. It is an approach that Pakistan could benefit from.

They also have rules to protect people, animals and the environment, and ensure they are followed.

New Zealand, a country of nearly five million people, is exporting milk worth 5.5 billion dollars. Of course, a big advantage they have is that their population is smaller. In fact, there are currently more dairy cows than people in New Zealand.

But this is not to say that low population is a must for success. The US has a sizeable population and considerable demand for milk, but they are still the world’s third largest exporter of dairy products.

Pakistan should learn from these countries and their government support programmes, not only to improve exports, but to also try and address supply chain issues at home. Pakistan has serious faults in its milk supply chain.

It is disheartening that a country that produces millions of litres of milk annually, only to waste a great deal of it, has children suffering from hunger and malnutrition. If urgent steps are not taken to overcome the issue of malnutrition, the quality of our human resource will be further damaged and the youth, which we consider the pillar of the nation, will become a burden not only for their families but also the national exchequer.

Experts believe that Pakistan must also consider importing high yield animals. Some dairy companies selling packaged milk have indeed imported animals which give higher yield compared to local animals. But to see a large-scale impact of this strategy, the government should provide support in importing high yield animals in bulk, to further increase Pakistan’s milk production. The government could also assist in setting up cheese manufacturing plants and storage facilities along the way.

Furthermore, as is the case around the world, more stringent rules and regulations should also be adopted with regards to dairy and cattle farming.

For example, in Karachi, where approximately 12 cattle colonies are functioning, the owners of dairy farms separate calves from buffaloes immediately after birth, and sell them for slaughter. The calf mortality rate in Sindh is the highest in Pakistan. The Government of Sindh and the Government of Pakistan could join hands to improve the conditions of these cattle colonies, and offer incentives and training to cattle farmers. There is also a need for stricter checks and balances, so farmers are discouraged from adopting practices such as using hormones to increase milk production.

RURAL URBAN MIGRATIONS

Another serious problem that Pakistan is facing is rapid migration from rural areas to urban centres. It is expected that, in the next 15 to 20 years, the country’s urban population will be more than its rural population. To avoid this movement, the government needs to find solutions that can encourage people to stay in the rural areas. The best way, of course, would be to provide health, education and earning opportunities to people in the rural areas.

Developing the dairy sector can be a solution here as well. According to a May 2020 Dawn news report, the industry transferred 120 billion rupees to 250,000 farmers, many of whom are women. But the dairy sector has the ability to support many more families of farmers.

Stemming the migration to urban areas is also important because Pakistan’s dairy sector is highly dependent on farmers who own herds of three or four buffaloes. If these small farmers are forced to migrate to the urban centres because of unsatisfactory economic and social conditions, Pakistan’s local milk production will be hampered.

Production of cheese, butter and ghee as by-products of milk is also a common occurrence in the houses of dairy farmers in the rural areas. Women who are assigned the task of milking the animals in the rural or semi-urban areas have expertise in making these products, but their skills are often under-utilised.

Today, the world believes that cottage industries are vital for the progress of any country. China pulled millions of people out of poverty by promoting its cottage industries. Pakistan has, time and again, made commitments to follow China’s model for poverty alleviation. But, so far, no concrete step has been taken in this direction.

Initiatives such as setting up cottage industries would not only empower these farmers, it would also help ease the burden on Pakistan’s already overcrowded urban centres. As we have seen around the globe, these small industries can be revolutionary and can maximise production.

MISSED OPPORTUNITIES

The World Bank, in one of its reports in the Pakistan at 100 series, highlighted that Pakistan has failed to reap the benefits of trade and regional amalgamation. Pakistan’s trade-to-GDP ratio was neck to neck with that of its neighbours in the early 2000s, but then fell behind drastically as the country failed to utilise export trade as an engine of growth.

From 2005 to 2017, India’s exports of goods and services increased by 216 percent, Bangladesh’s by 250 percent and Vietnam’s by 519 percent. In comparison, Pakistan’s exports increased by only 50 percent, from 19.1 billion dollars to 28.7 billion dollars.

Additionally, access to international markets has helped firms in South Asia to grow and become more productive. There are many channels through which trade has promoted productivity growth: competition, knowledge spill-over, and access to better technology and quality inputs. Bangladesh’s garment industry and India’s auto industry are some of the well-known success stories. But Pakistan, unfortunately, has failed to take full advantage of the available trade opportunities because of trade policy constraints, logistical issues and inadequate regional integration.

Another major issue, however, has always been a lack of imagination and understanding of global market trends.

An example of this is the halal food market. The global halal food market’s size reached 1.7 trillion dollars in 2019. And, unsurprisingly, the market is dominated by non-Muslim countries, with countries such as Brazil being the market leaders.

Despite being a country where only halal ingredients are used to prepare foods, Pakistan has lagged behind. We have all the potential to make our mark in the global halal food market, but have failed to make our presence felt.

Pakistan must not similarly lose out on the dairy products market. For years now, analysts and journalists have been writing about the potential of the dairy sector, but, alas, to no avail. This must now change.

CRYING OVER SPILT MILK

Not only has the potential of the dairy sector in Pakistan remained untapped, the lack of forward-thinking policies and support in export has actually landed the industry in trouble. As prices of packaged milk and dairy products are rising, local demand continues to fall.

The answer to the dairy sector’s woes clearly lies in tapping into the global market in the way countries such as Indonesia, Thailand, Malaysia, South Africa, Bangladesh, Sri Lanka and Turkey have.

The recent news of the Chinese Huiyu group signing a memorandum of understanding with Nestle Pakistan for importing dairy products from Pakistan is a welcome step in the right direction. Only through more such arrangements will Pakistan be able to turn large profits in its dairy sector and milk it for all its worth.

The writer is interested in Pakistan’s economy and trade. His writing has appeared in various Pakistani dailies and publications. He tweets @KhurramZiaKhan

Published in Dawn, EOS, March 7th, 2021