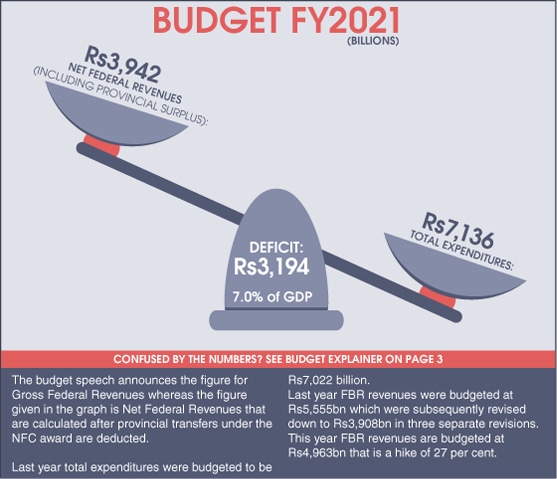

• Deficit worked out at Rs3.195tr

• Rs2.946tr set aside for debt servicing

• Salaries, pensions of government employees frozen

• PSDP slashed to Rs650bn

• FBR tax collection target set at Rs4.963tr

• Subsidies cut down by 48pc

• Rs70bn earmarked for coronavirus-related schemes

• Allocation for Ehsaas programme increased from Rs187bn to Rs208bn

ISLAMABAD: With Covid-19 as the context and the International Monetary Fund (IMF) programme as the yardstick, the government unveiled a budget built around austerity and belt-tightening and increasing tax revenue by over 27 per cent to Rs4.963 trillion, but without any discernible revenue plan behind it.

“There are no new taxes in this budget,” Minister for Industries and Production Hammad Azhar announced during his budget speech in the National Assembly.

The speech was marred by loud protests from the opposition as well as a sparse attendance due to ongoing social distancing measures being observed in parliament. This is the first time in the country’s history that the budget speech was delivered by a minister wearing a face mask.

The budget cuts down subsidies by 48pc, hikes petroleum levy by almost 73pc, freezes salaries and pensions and yet fails to arrest the overall fiscal deficit during 2020-21, projected almost unchanged at 7pc of GDP (7.2pc in budget 2019-20).

Most of the expenditure items are estimated to go down next year, except for debt servicing and defence expenditure, while about Rs70bn will be specifically spent on Covid-19-related schemes to support living conditions of the vulnerable.

Presenting the PTI government’s second full-year budget as “relief budget”, Mr Azhar announced a reduction in duties and taxes and measures for improved collections as Prime Minister Imran Khan and Adviser on Finance and Revenue Dr Hafeez Shaikh kept on desk thumping.

An official explained that the budget had been prepared to pass through the Financial Action Task Force (FATF) challenge and put on track the IMF programme over the next quarter while fighting back the pandemic-related economic stress and then follow up with more than Rs700bn revenue plan sometimes in September-October. About Rs350bn was expected to accrue through 2.1pc nominal economic growth and 6.5pc inflation.

That’s why the minister announced that expansionary fiscal policy was required to overcome the crisis situation threatening the economic growth rate. He said key nodes of the budget strategy included successful continuation of the IMF programme, providing relief to people, balancing between Covid-19 expenditures and budget deficit, maintaining a reasonable primary balance (-0.5pc) and triggering economic activities. The budget deficit is worked out at Rs3.437tr (7pc of GDP), which after an estimated provincial surplus of Rs242bn, comes to Rs3.195tr.

At the same time, Rs650bn development budget would help increase the growth rate and generate jobs and encourage the construction sector while giving importance to national defence and internal security and improving revenues without unnecessary changes to taxes. The defence allocations have been increased by 12pc to Rs1.289tr from Rs1.152tr in the current year’s budget. The industrial sector has been offered facilities in the shape of reduced tariff lines.

The minister said a task force on austerity and reform had proposed privatisation of 43 institutions, abolition of eight non-functional institutions, transfer of 14 others to the provinces and merger of 35 with other institutions. This restructuring would help significantly reduce fiscal burden on the federal government.

Moreover, the National Finance Commission (NFC) would be revisited and the provinces would be made to honour their commitments for financial support they had promised at the time of merger of former tribal regions with Khyber Pakhtunkhwa.

On top of that, the austerity and reduction in unnecessary expenditures would be ensured at all costs.

As such, the next year revenue target has been set at Rs6.573tr, including FBR revenue of Rs4.963tr and non-tax revenue of Rs1.6tr that is almost the same when compared with revised estimates for the current year. An amount of Rs2.874tr would stand transferred to the provinces, leaving behind net revenues for the Centre at Rs3.7tr.

The size of the federal budget has been set at Rs7.137tr, which is almost 11pc lower than the budget estimates of 2019-20. The overall subsidies have been targeted to be slashed by 48pc to Rs180bn for the next year against Rs350bn this year, while power sector subsidies would come down from Rs200bn this year to Rs124bn next year, a fall of 38pc.

The cost of debt servicing has been estimated at Rs2.946tr for the next year, slightly higher than Rs2.89tr. The estimate for current expenditure is set at Rs6.345tr against Rs6.192tr this year, showing an increase of just 2.5pc.

The fiscal deficit would be financed through Rs2.38tr domestic financing and Rs810bn external financing. About Rs100bn is targeted to be generated through privatisation proceeds.

For the first time, the government also listed a host of fiscal risks to the budget as required under the Public Management Act 2019, which have a reasonable chance of materialising in the budget year 2020-21 and medium-term.

Among the economic risks, the finance ministry noted that for the first time in many decades, Pakistan’s economy has entered into recession as GDP contracted by 0.4pc in 2019-20. As per the current estimates, economic growth is projected at 2.1pc in 2020-21. However, there are downward risks to target growth emanating from two uncertainties — worsening global economic situation and prolonged recovery in domestic markets.

If these risks materialise, the tax revenue collection target is likely to be impacted. However, these are categorised as short-term risks predominantly affecting 2020-21 forecasts. The medium-term outlook remains positive and economic growth is projected to see a sustained recovery.

On the other hand, energy sector losses are also a major risk to the budget. This includes high off-budget arrears and liabilities emanating from non-reduction of flow of energy sector losses, and non-payment of arrears and liabilities.

Published in Dawn, June 13th, 2020