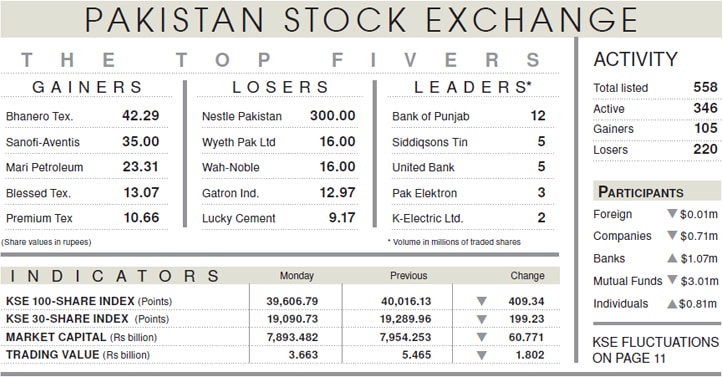

KARACHI: Stocks fell further on the first trading day of the week with the KSE-100 index dragged down by 409.34 points (1.02 per cent) and closed at 39,606.79.

Investors were disinclined to trade in the absence of triggers while concerns over geopolitical situation forced investors to liquidate their positions. Other factors that dampened investor sentiments included lack of report on the progress with the International Monetary Fund for bailout package and the simmering temperature on the eastern border.

The market opened 26 points down but turned green for a short while and climbed to intra-day high by 30 points. The index latter succumbed to selling pressure coming mainly from mutual funds that sold equity worth $3.01 million which saw the index hit the intra-day low by 465 points. Selling pressure emanated mainly in the banking sector where United Bank Ltd (UBL) and Habib Bank Ltd (HBL) plunged for the third day. Foreign investors remained on the sidelines with net sale of stocks worth only $0.01m.

The trading volume fell 31pc to 68m shares from the previous day’s from 99m shares and its value also declined by 33pc to $26m from $39m.

Commercial banks, cements and fertilisers were the worst performers as they chipped away 247 points, cumulatively. Other sectors contributing to the market downside included include exploration and production companies down 42 points and power losing 33 points.

Scrips that contributed the highest losses included HBL down 2.6pc, UBL 3.5pc, Hub Power Company 1.8pc, Lucky Cement 1.9pc, Oil and Gas Development Company 0.9pc, Pakistan Petroleum Ltd 0.9pc, Engro Corporation 0.7pc and Bank Al Habib Ltd 1pc. Indus Motor also fell 0.60pc in the auto sector as it reported 1HFY19 earning per share of Rs87.94 with an interim dividend at Rs25.

Stocks that contributed positively include Fauji Fertiliser Company adding 8 points, Shifa International Hospitals 5 points, MCB Bank Ltd 5 points, Pakistan Oilfields Ltd 3 points, and Standard Chartered Bank (Pakistan) Ltd 3 points.

Published in Dawn, February 26th, 2019