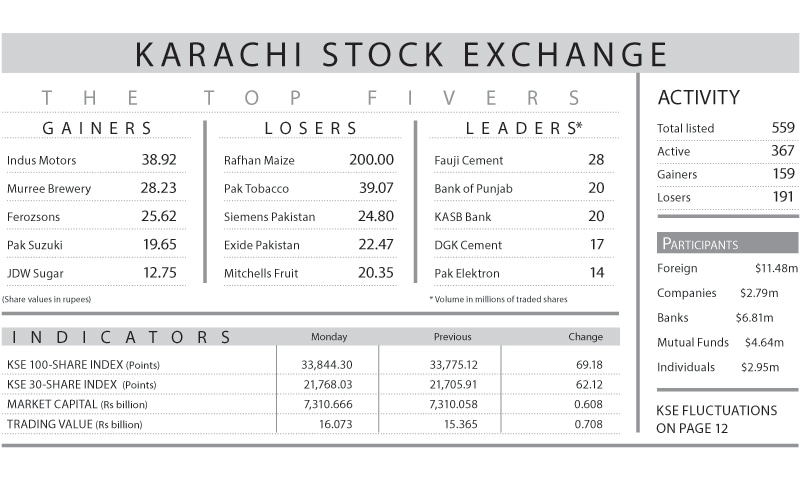

KARACHI: Stocks moved forward on Monday with the KSE-100 index adding 69.18 points, or 0.20 per cent, to settle at 33,844.30.

Volumes fell to 263 million shares of Rs16.1 billion value, against Friday’s volume of 307m shares of Rs15.4bn.

Foreign investors bought substantial shares of net $11.48m. Major buying was seen in cement $5.5m, chemical $4.2m and banking sector $3.7m. Mutual funds purchased $4.64m, while banks sold stocks worth $6.81m.

Brokerage Topline Securities stated that the investors booked profits in Fauji Cement, after the company did not declare any cash dividend with the results. The stock closed 1.8pc down.

|

Pakistan State Oil also fell by 0.6pc after the company declared loss in Jan-March 2015. However, interim dividend of Rs6 per share was a surprise for the market.

Engro Corporation remained in the limelight, with 9m shares traded of Rs2.8bn, ahead of its planned private placement of Engro Fertiliser.

Analyst Ahmed Saeed Khan at JS Global stated that after the initial gains of 196 points, the market receded. The government’s announcement of reducing the PSDP by Rs58bn had an adverse impact on the cement sector. Most of the scrips were down including FCCL by 1.7pc, PIOC by 1.1pc, CHCC by 1pc and KOHC shed 0.5pc.

As Arab Light trades above $60 per barrel, ATRL rose 5pc, SHEL by 2.6pc and NRL gained 1.1pc, making the oil sector favourable in the short-term.

Analyst Ahsan Mehanti at Arif Habib Corp said that the trade remained high led by second and third tier stocks. Post results consolidation in cement, oil and banking stocks invited late session profit-taking.

Analyst Fahad Hussain Khan at Adam Securities commented that bulls started the week on a strong note.

Published in Dawn, April 28th, 2015

On a mobile phone? Get the Dawn Mobile App: Apple Store | Google Play

Dear visitor, the comments section is undergoing an overhaul and will return soon.