NEW YORK: Oil prices climbed about two per cent to a four-month high on Monday on lower crude exports from Iraq and Saudi Arabia and signs of stronger demand and economic growth in China and the US.

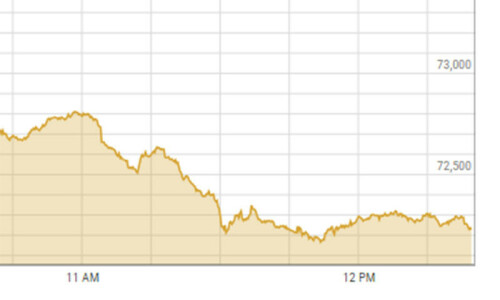

Brent futures rose $1.45, or 1.7pc, to $86.79 a barrel by 1:50pm EDT (1750 GMT), while US West Texas Intermediate (WTI) crude rose $1.54, or 1.9pc, to $82.58.

That pushed both benchmarks into technically overbought territory with Brent on track for its highest close since Nov 2 and WTI on track for its highest close since Oct 27.

In other energy markets, US gasoline futures were on track to close at their highest price since August 2023.

On the supply side, Iraq, Opec’s second-largest producer, said it would reduce crude exports to 3.3 million barrels a day (bpd) in the coming months to compensate for exceeding its Opec+ quota since January, a pledge that would cut shipments by 130,000 bpd from last month.

In January and February, Iraq pumped significantly more oil than an output target established in January when several members of the Organisation of the Petroleum Exporting Countries (Opec) and allies like Russia, a group known as Opec+, agreed to support the market.

In Saudi Arabia, Opec’s largest producer, crude exports fell for a second straight month, down to 6.297 million bpd in January from 6.308mbpd in December.

In Russia, meanwhile, Ukrainian attacks on energy infrastructure have idled around 7pc of refining capacity in the first quarter, according to a Reuters analysis.

Market participants said refinery outages will push Russia to increase oil exports through its western ports in March by almost 200,000 bpd to around 2.15mbpd.

In the US, meanwhile, oil output from top shale-producing regions will rise in April to the highest level in four months, according to a federal energy outlook.

Growing demand

In China, the world’s biggest oil importer, factory output and retail sales beat expectations in the January-February period, marking a solid start for 2024 and offering some relief to policymakers even as weakness in the property sector remains a drag on the economy and confidence.

“Crude oil is up ... today. With demand for crude from China continuing to be a dominant factor,” analysts at energy consulting firm Gelber and Associates said in a note.

Published in Dawn, March 19th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.