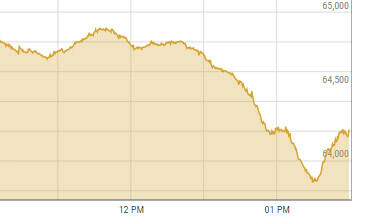

After two consecutive sessions of selling pressure, some positivity returned to the Pakistan Stock Exchange (PSX) on Thursday after it gained more than 1,000 points in intraday trade.

The KSE-100 index gained by 1,015.82 points, or 1.59 per cent, to close at 65,064.26 from the previous close of 64,048.44.

Yousuf M. Farooq, director of research at Chase Securities, attributed the bullish momentum to “improved clarity on the political and economic fronts”.

Farooq recounted the new finance minister’s interview with Geo News last night where he “articulated a clear plan for the economy going forward and emphasised that the first quarter of year showed notable improvements in stability compared to last year”.

He added, “The market has responded positively to the minister’s optimistic and prudent statements yesterday.

“Some participants are now anticipating a rate cut on March 18th, marking a departure from previous monetary policy expectations where rate cuts were not anticipated,” he said.

In the interview on Geo News, the finance minister reiterated the need to get “our house in order by reducing government expenditure”. He further emphasised that it was necessary to move toward [attracting] investment, as the “friendly countries want to help us but not through aid”.

When asked about the International Monetary Fund (IMF), the finance minister remained clear on concluding the IMF programme to “get the $1.1 billion tranche released”.

Awais Ashraf, director of research at Akseer Research, echoed the sentiments on the rate cut.

“The expectations of monetary easing — as indicated by the finance minister — and of no new conditions for the disbursement of the IMF’s last tranche of $1.1bn, as the country has met all structural benchmarks, have boosted investor sentiment,” he said.

Shahab Farooq, director of research at Next Capital Limited, attributed the upward trajectory to “anticipation of a positive outcome from the negotiations with the IMF on the final tranche of the ongoing SBA”, coupled with the expectations of a rate cut due to the decline in cut-off yields of Pakistan Investment Bonds (PIB) in the recent auction.

Additionally, Farooq said that the “clear-sighted statements of the newly appointed finance minister fuelled positive sentiments at the PSX”.

However, he cautioned that the turnover remained low due to caution practiced by investors and reduced trade time during Ramazan.

Dear visitor, the comments section is undergoing an overhaul and will return soon.