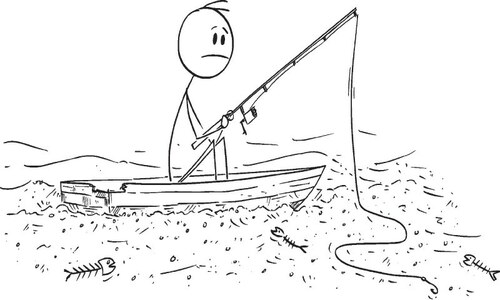

Shares at the Pakistan Stock Exchange (PSX) opened the week in the red, with analysts attributing the slump to uncertainty over an agreement with the International Monetary Fund (IMF).

The benchmark KSE-100 index lost 444.97 points, or 1.08 per cent, to close at 40,673.64 points. It reached an intraday low of 494.64 points, or 1.2pc, around 3:27pm.

Aba Ali Habib Securities’ Head of Research Salman Naqvi said there were a number of factors that affected the market negatively, especially economic uncertainty amid delays in reaching an agreement with the IMF for a bailout needed to stave off default.

He noted that the parliament has not yet passed the Finance (Supplementary) Bill, 2023, generally known as the mini-budget, which imposes additional taxes to fulfil the IMF’s conditions.

In addition, there were rumours that the central bank would hike the interest rate by 2-3pc. “Even though the Monetary Policy Committee meeting is scheduled for March 13, the policy rate may be increased sooner.”

Besides this, there was also uncertainty on the political front and the law and order situation was worsening. “All of these factors affected the market negatively,” Naqvi commented.

Topline Securities Senior Manager Equity Mohammad Arbash also said that investors were awaiting clarity about the IMF deal.

The KSE-100 also fell because of a decline in the share prices of two index heavyweights — Oil and Gas Development Company Limited (OGDCL) and Pakistan Petroleum Limited (PPL), he said. The share prices of both companies were down over 5pc at the day’s end.

“Further, rumors of emergent monetary policy also dented investors’ sentiments as they are expecting a 200 basis points increase,” he added.

An IMF delegation had visited the country from Jan 31 to Feb 9 but departed without a staff-level agreement being reached. The government and the IMF resumed virtual talks on Feb 13, with Finance Secretary Hamed Yaqoob Sheikh saying the government intended to “wrap them up at the soonest”.

During the talks, the IMF had asked the government to raise an additional Rs170 billion in tax revenue. The bulk of tax measures worth Rs115bn was already implemented from Feb 14 through Statutory Regulatory Orders (SROs). The rest of the Rs55bn will be raised through measures proposed in the finance bill.

Pakistan is in dire need of funds as it battles a worsening economic crisis. Foreign exchange reserves have fallen to around $3bn, barely enough to cover three weeks of controlled imports. An agreement with the IMF would not only release a $1.2bn bailout but also unlock other avenues of funding for Pakistan.

Dear visitor, the comments section is undergoing an overhaul and will return soon.