The government would soon be delisting two mega LNG-based power plants of about 1,230MW each — Balloki and Haveli Bahadur Shah — from the privatisation agenda for their expedited sale on a government-to-government (G2G) basis.

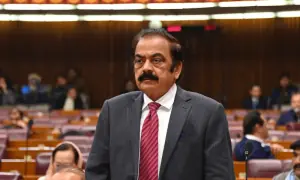

The government has been in talks with friendly governments in the Middle East, including Qatar, for the sale of at least two out of four LNG-based power plants, the most efficient so far, on a G2G basis to raise more than $2 billion direly needed to support fast diminishing foreign exchange reserves. Finance Minister Ishaq Dar’s visit to Doha last week is slated to have taken place in this background.

Qatar has been pursuing creating a comprehensive LNG chain in the country, from its own LNG cargoes to the setting up of LNG terminals and dedicated long-term LNG buyers. But this has been mishandled by deep-rooted vested interests that run through various governments, including the previous and incumbent.

This is despite the fact Qatargas remains the only trusted long-term LNG supplier since 2016, which has gone beyond its contractual responsibilities to deliver supplies to Pakistan while all other long-term and spot LNG suppliers repeatedly defaulted on cargo deliveries. At the same time, Qatar also enjoys very cordial relations with Pakistan, both in the political and defence circles, that can address hurdles.

Interestingly, a meeting at the planning commission last week noted that the existing long-term contracts with Qatargas include a clause for contract revision in 2026. This also included a revision of the price cap, and the supplier could demand an increase in the LNG delivered cost or just walk away from the contract. Therefore, Pakistan should expedite the process of entering into fresh long-term LNG import contracts.

Pakistan should expedite the process of entering into fresh long-term import contracts since the supplier can demand an increase in LNG’s delivered cost or walk away from the contract

Top officials said the delisting of LNG plants from the privatisation list would be immediately notified once Doha affirms the transaction. In this background, the privatisation commission board had recommended the privatisation of LNG plants through the normal and long course of action under the privatisation commission law a couple of weeks back. The cabinet committee on privatisation led by Finance Minister Dar did not approve that route and withheld the case.

To facilitate the proposed privatisation of power plants on a G2G basis, the Economic Coordination Committee (ECC) of the Cabinet has already approved changes to the gas sale agreements of three LNG-based power projects earlier this month in Punjab.

The previous PTI government had in April 2021 waived the minimum 66 per cent take-or-pay commitment in the gas supply agreements (GSA) and power purchase agreements (PPAs) and had also relieved them (practically power division) from the requirement of annual production plan for firm gas commitment by replacing them with monthly gas plans. The decisions practically came into practice, but related amendments to GSA and PPAs could not be given legal effect. This delayed the privatisation of these power plants.

The same power division later realised that given the unprecedented rise in the cost of LNG, the April 2021 decision should be revisited to optimise the utilisation of LNG for continued operations of these power plants, thus enabling their security of operations to the new buyer.

Also, it proposed capping the gas sale deposit (GSD) payable by these plants to gas companies at Rs15bn per plant instead of the significantly higher amount (Rs60bn) that was worked out under the existing arrangement at one-fourth price of maximum LNG allocation.

Therefore, on the request of the power division, the ECC approved changes to the April 2021 decision and concluded that instead of completely doing away with 66pc minimum take or pay commitment, it should be fixed at 33pc to “guard the interests of both buyers and suppliers”.

Secondly, it also approved that the GSD under the GSA be fixed at Rs15bn per power plant instead of (Rs60bn) the existing GSD, equivalent to one-fourth of the maximum gas allocation valued at the current applicable gas price inclusive of taxes.

The transaction adviser Credit Suisse Singapore, which had been associated with the transaction since April 2019, had told Islamabad that finalising and executing the security package — involving gas-sale, power-purchase and implementation agreements — and resolving other central issues affecting privatisation, particularly payment of receivables, had been the “main reasons that have halted the National Power Parks Management Company transaction process”.

The previous PML-N government took up the two Punjab-based plants in tandem with building the first LNG terminal and signing a long-term LNG supply agreement with Qatar on a war footing to overcome crippling power cuts.

Under that arrangement, the plants were to be operated on a must-run basis (meaning the grid should always accept any power generated by them) with a guaranteed 66pc LNG supply by gas companies on a take-or-pay basis with the annual gas delivery plan.

However, the power sector did not follow through with back-to-back power purchase agreements and payments against LNG supplies to reduce power companies’ financial exposure that remained parked with gas companies.

As a result, in April 2021, the PTI government approved the waiver of a minimum 66pc take-or-pay commitment in the power purchase and gas supply agreements of three RLNG-based public sector power plants, including Quaid-i-Azam Thermal Power Plant, Balloki Power Plant and Haveli Bahadur Shah Power Plant.

The Sui Northern Gas Pipelines Ltd (SNGPL) and the petroleum division had been opposing the move because it exposed petroleum sector companies — Pakistan State Oil (PSO), Pakistan LNG Limited and the SNGPL itself — to losses and “practically shifted circular debt from power companies to petroleum companies”.

The PTI’s decision entailed a major shift and envisaged submission of a monthly production plan binding on the power purchaser and the power seller (the National Transmission and Despatch Company and the power plants) under which the power purchaser is entitled to submit demand requirements as needed, at least 75 days before the start of each such month.

The petroleum division, however, kept protesting that the entire LNG supply chain — including 800-900 million cubic feet per day (mmfcd) of imports from Qatar and the open market, regasification terminals, PSO and the gas network, had been put in place on the basic premise of LNG power plants and would become unsustainable in the long term just for short-term gains of privatisation proceeds. In 2019, the cabinet decided that the 66pc obligation on power plants would remain intact until the first LNG price review in 2026.

Published in Dawn, The Business and Finance Weekly, January 30th, 2023