KARACHI: Share prices rose on Tuesday as the benchmark continued its earlier momentum over the expectations about a rollover of $13 billion international debt payment.

Topline Securities said investors welcomed the decline in international coal prices, which pushed the cement sector into the limelight.

According to Arif Habib Ltd, the session was range-bound even though the index remained in the positive zone throughout the day.

Investor participation was sluggish throughout the trading session as they continued value-hunting across the board. Share prices of companies belonging to the cement sector were in focus owing to a favourable trend in coal rates internationally.

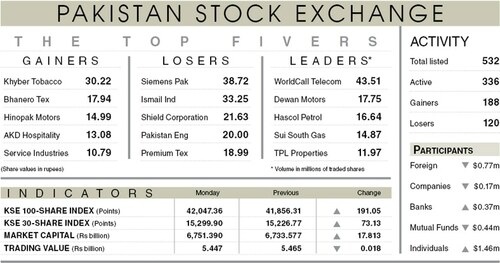

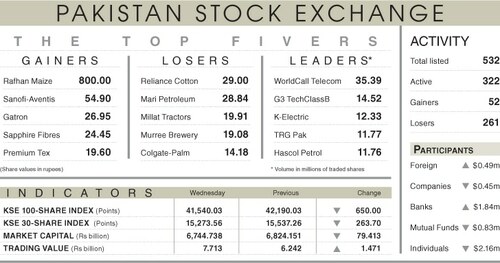

As a result, the KSE-100 index settled at 42,265.36 points, up 218 points or 0.52 per cent from the preceding session.

The trading volume decreased 1.2pc to 237.4 million shares while the traded value went up 6.5pc to $26.2m on a day-on-day basis.

Stocks contributing significantly to the traded volume included Fauji Foods Ltd (31m shares), WorldCall Telecom Ltd (22.9m shares), Cnergyico PK Ltd (14.3m shares), Hascol Petroleum Ltd (13.4m shares) and HBL Total Treasury ETF (8.8m shares).

Sectors that contributed to the index performance were commercial banking (97.9 points), cement (61.6 points), fertiliser (43.2 points), exploration and production (40.3 points) and automobile assembling (26.7 points).

Companies registering the biggest increase in their share prices in absolute terms were Reliance Cotton Spinning Mills Ltd (Rs43.85), Khyber Tobacco Company Ltd (Rs32.49), Shield Corporation Ltd (Rs18.46), Indus Motor Company Ltd (Rs15.35) and Al-Abbas Sugar Mills Ltd (Rs14).

Shares that declined the most in rupee terms were Rafhan Maize Products Company Ltd (Rs854), Allawasaya Textile and Finishing Mills Ltd (Rs249.16), Pakistan Services Ltd (Rs29.30), Pakistan Tobacco Company Ltd (Rs20) and Blessed Textiles Ltd (Rs18.88).

Foreign investors remained net buyers as they purchased shares worth $0.12m.

Published in Dawn, November 9th, 2022