AS the fog cast by political uncertainty appears to settle with the appointment of Prime Minister Rishi Sunak, one thing is clear: a long winter of financial hardship is on the cards for households across the country.

The cost of living crisis has forced around 24 million people in Great Britain to reduce energy use at home, and 16 million to cut back on food and essentials. But among those affected, ethnic minorities fear the worst. With nine in 10 adults in Great Britain reporting higher costs of living compared to last year, a recent study shows that Pakistanis in the UK are up to 3.3 times more likely to be in relative poverty than white people.

In an analysis titled ‘Falling faster amidst a cost-of-living crisis’, think-tank Runnymede Trust wrote, “Despite only making up around 15pc of the population in the UK, more than a quarter (26pc) of those in ‘deep poverty’ (i.e. more than 50pc below the poverty line) are from a minority ethnic background.”

Since 2021, high inflation, tax increases, skyrocketing energy bills and stagnant incomes have created the perfect storm for a cost of living crisis that comes on the heels of post-pandemic hardship. Together, the increasing prices of food, electricity and fuel have delivered a heavy blow.

Even in 2008 there was a recession, but there is a night and day difference between then and now, says a mother in Birmingham

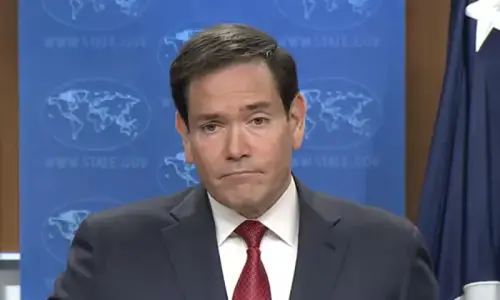

Habib Shah, a 55-year-old working as a part-time chef in a London hospital’s catering department, said families are hit hard. “Even those who have a stable income are worried.”

Based in Harrow, Shah echoes the sentiments of many within his community. Weekly grocery bills of basic items such as meat, milk and yogurt have climbed. “Our expenses are no longer covered by the balance in the bank. We have to now rely on overdrafts,” he said.

He added that monthly groceries of basic items such as meat, milk and yogurt which previously cost GBP200 are now easily over GBP300. Gas and energy bills have gone from GBP60 a month to GB158. In the winter months, they are expected to cross GBP200.

“It’s not a small difference, it’s serious. If we don’t have enough to pay bills or rent, how will we survive? What will people do about the mortgages they have taken for shops and homes?”

Saima Haroon, a stay-at-home mother living in Birmingham for past 20 years, said the recent rise in costs is “the most drastic in two decades”. She said the government’s decision to increase food and energy prices after the pandemic and lockdown was a huge shock. The British Pakistani community has been badly affected, she said, adding that “this is the story of every household” and being discussed.

“Even in 2008 there was a recession, but there is a night and day difference between then and now. Yes, prices were high then but the situation was not this bad. This double burden of food and energy prices being high are unbearable.”

Her weekly grocery bill which would usually be GBP80 pounds is now easily GBP150. “We would easily live within our budgets earlier, but now we have to think twice to shave off costs,” she said, adding that this year the family was reluctant to turn heating on even in mid-October because of the impending bills.

Shugufta Naz, a beautician in Birmingham, had a similar story to share. “We have to think twice before buying each and every thing. I used to buy things I liked for the kids, but now I have stopped doing that. The bills have shaken me,” she said. As jobs are stagnant, the rising costs have presented huge challenges for both British and Indian Pakistanis, she added.

The ongoing political circus in the country doesn’t inspire much confidence.

Workforce relocation

Haroon said the situation is giving rise to conversations in Pakistani households about seeking employment in other countries. “If this continues, living in Britain will be untenable. If there are better prospects elsewhere, families will be forced to relocate.”

Research by not-for-profit organisation People Like Us revealed that “34pc of professionals from racially diverse backgrounds say their salary won’t cover their mortgage, rent and energy bills”.

It added, “Working professionals from racially diverse backgrounds are nearly twice as likely to have been told they won’t be getting a promised pay rise this year due to inflation (19pc compared to 10pc of white professionals), and are now twice as likely as white professionals to think the current economic situation will increase the pay gap (26pc vs 13pc).”

“Over a third (35pc) of ethnic minority professionals will rack up extra debt by taking out loans or spending on credit cards, with nearly a third (31%) borrowing money from someone they know.”

Remittances affected

The decrease in purchasing power in the UK means families have to rethink how they spend here, if they want to continue to support loved ones back home.

According to research released in 2022 by WorldRemit, a digital cross border remittance business, two-fifths of Brits now send money abroad to fewer people, with another fifth reporting feeling increased pressure by loved ones to send even more money abroad.

Speaking to Dawn, Karen Jordaan, the company’s head of the UK, said, “Pakistan and the UK have both experienced skyrocketing inflation rates, creating a weaker currency in both nations, and a decreased amount that Brits can now afford to send. British senders are changing their spending behaviour to continue to transfer money abroad. 52pc of respondents from our recent research reported going out to eat less, 19pc use public transport more than driving and 26pc attend fewer social events so that they can keep up with their obligations to provide financially for friends, family and loved ones overseas.”

Chef Shah said, “The gap is increasing and there is little to nothing left over. I used to send my mother GBP 100 every month in Pakistan, now it has dropped to GBP 60.”

Published in Dawn, October 26th, 2022