KARACHI: The stock market remained under pressure on Wednesday owing to a major sell-off in banking stocks.

Arif Habib Ltd said the cement sector also stayed in the red zone because of an increase in the Afghan coal price and export tax. Value buying took place in the exploration and production sector. The market witnessed across-the-board profit-taking in the last trading hour.

JS Global said the major reason for the drop in share prices was that investors worried about the lack of clarity on the Finance Bill and the deal with the International Monetary Fund. The brokerage also recommended that investors should stay cautious and adopt a buy-on-dip strategy in banking and the exploration and production sectors.

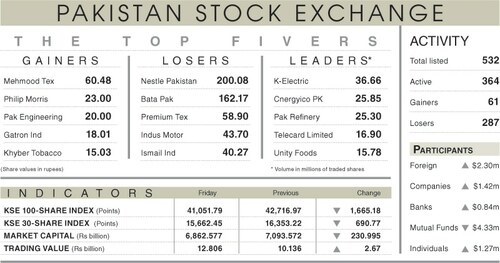

The KSE-100 index settled at 41,297.73 points, down 467.89 points or 1.12 per cent from a day ago.

The trading volume decreased 44.7pc to 142.2 million shares while the traded value went down 30.6pc to $26.1m on a day-on-day basis.

Stocks contributing significantly to the traded volume included K-Electric Ltd (14.3m shares), WorldCall Telecom Ltd (11.61m shares), Hascol Petroleum Ltd (7.56m shares), Cnergyico PK Ltd (5.71m shares) and TPL Properties Ltd (4.36m shares).

Sectors that took away the highest number of points from the benchmark index included commercial banking (271.55 points), oil and gas exploration (58.63 points), technology and communication (56.76 points), cement (23.25 points) and power generation and distribution (17.61 points).

Shares contributing most negatively to the index included Habib Bank Ltd (90.23 points), MCB Bank Ltd (69.18 points), Systems Ltd (45.23 points), Bank AL Habib Ltd (42.35 points) and Mari Petroleum Company Ltd (23.09 points).

Stocks that contributed most positively to the index included Colgate-Palmolive Company Pakistan Ltd (8.79 points), Engro Fertilisers Ltd (6.95 points), Sui Northern Gas Pipelines Ltd (5.96 points), Javedan Corporation Ltd (5.75 points) and Pakistan Tobacco Company Ltd (5.34 points).

Foreign investors were net sellers as they offloaded shares worth $0.24m.

Published in Dawn, June 30th, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.