KARACHI: Trading on the stock market remained volatile on Thursday after the country reported the highest number of Covid-19 cases in the last four months, according to Arif Habib Ltd.

The shares market opened on a bleak note as investors remained risk-averse. Cnergyico PK Ltd remained in the limelight after its board approved the acquisition of 57.37 per cent shares in Puma Energy — a move that’ll make the integrated energy entity the second-largest retail fuel network operator in Pakistan.

In the last trading hour, profit-taking was witnessed across the board, with hefty volumes in third-tier stocks.

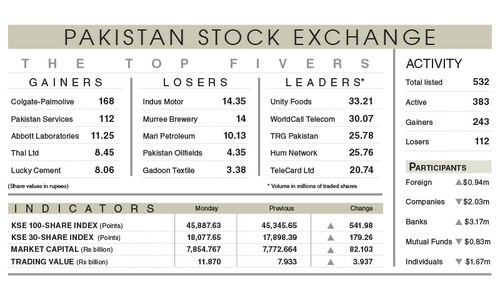

As a result, the benchmark index lost 153.05 points or 0.33pc to close at 45,763.20 points.

Market participation decreased 36.3pc to 327.6 million shares while the value of traded shares went down 38.9pc to $36.7m.

Sectors taking away the highest number of points from the benchmark index included technology and communication (50.34 points), cement (33.81 points), food and personal care (21.71 points), tobacco (14.30 points) and pharmaceutical (11.95 points).

Stocks that contributed significantly to the traded volume included Cnergyico PK Ltd (74.07m shares), WorldCall Telecom Ltd (47.81m shares), Hascol Petroleum Ltd (23.39m shares), Unity Foods Ltd (15.17m shares) and TRG Pakistan Ltd (9.82m shares).

Shares contributing positively to the index included Cnergyico PK Ltd (16.64 points), MCB Bank Ltd (12.45 points), Pakistan Oilfields Ltd (7.92 points), Indus Motor Company Ltd (7.22 points) and Engro Fertilisers Ltd (5.53 points).

Stocks that took away the maximum number of points from the index included TRG Pakistan Ltd (39.50 points), Lucky Cement Ltd (14.57 points), Pakistan Tobacco Company Ltd (14.30 points), Systems Ltd (12.33 points) and Unity Foods Ltd (10.95 points).

Stocks recording the biggest declines in percentage terms included Pakistan Tobacco Company Ltd, which went down 4.09pc, followed by TRG Pakistan Ltd (3.24pc), Gul Ahmed Textile Mills Ltd (3.08pc), Unity Foods Ltd (3.03pc) and Bannu Woollen Mills Ltd (2.56pc).

Foreign investors were net buyers as they purchased securities worth $0.112m.

Published in Dawn, January 14th, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.