Remember the good, old days when you could just book Careem for commuting without having to see four cancellations and pay a quarter of your salary on a single ride? Well, as they say, the past is another country. But seriously, what happened?

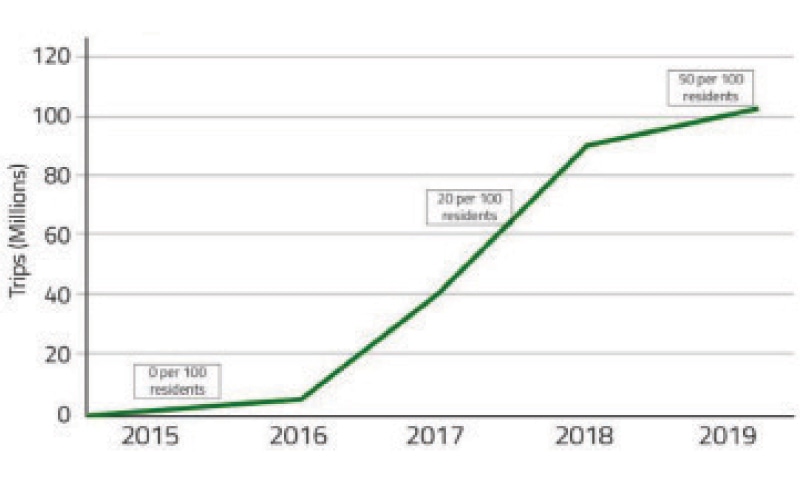

After all, this was the biggest a tech company had reached in Pakistan, at least in the consumer space. Between 2015 and 2019, the ride-hailing giant completed a cumulative 236 million trips of which 100m came in 2019 alone — its best year. That translates into almost 274,000 trips daily. Sure, things were always bound to change after the acquisition when the venture dollars stopped pouring in and the blitzscaling gave way to a more mature stage. Then obviously Covid-19 did its fair share of damage.

According to an Oxford Economics report on Careem shared with Dawn, the company had over 82,000 active captains in January 2020 collectively making 7.8m trips during the month — already below the peak levels. Come April, at the height of the lockdown, the corresponding numbers stood at just 10,400 and 380,000, plunging by 88 per cent and 95pc respectively. By December, the ride-hailing player had made 70pc recovery in active captain and 51pc in trips compared to the beginning of year values.

“If you look at the different markets in which the company operates, Pakistan has received the maximum amount of investment at over $100m,” says Careem CEO

But while ride-hailing continued to take a hit around the world, gig economy companies were quick to move into the food and grocery delivery space which boomed in the wake of the pandemic. That included Uber whose delivery gross bookings were $4.3 billion more than those from mobility in Q2CY21, helped by the acquisition of Postmates. Careem too had ventured into this arena with its NOW, which later simply became ‘food’ after the rollout of the super app. However, not much seems to have come out of it, at least in Pakistan where Foodpanda continues to grow its market by the day.

“Our delivery business has grown significantly, around 3-4x compared to pre-Covid-19. But unlike ride-hailing, where we went to the markets and started spending money like there was no tomorrow with lots of promos and incentives, there is no need to repeat the same approach this time. We have an installed user base of about 50m people, of which 20m are from Pakistan alone, so our strategy is a lot more organic,” says Careem’s co-founder and CEO Mudassir Sheikha. “We are basically saying let’s go country by country, win those markets and then go to the next one. Currently, the focus is on UAE, Saudi Arabia and Jordan,” he added.

Food is just one part of the broader super app that the company launched last year in June but again, the rollout appears to be a bit slow. “When the pandemic happened, very early on, we accelerated the super app and the delivery verticals. Food business which was relatively small became a much bigger focus for us, along with groceries, and Careem Pay. Post Covid-19, we saw the emergence of a different Careem, as a super app instead of a ride-hailing company. And that has really been a saviour as the core business has recovered but not to the full extent, these other engines of growth have ensured that we are relatively close to the pre-coronavirus levels,” Sheikha says.

So far, the one market they have come closest to realising their super app vision is the UAE where the platform allows 16 services including car, delivery, intercity rides, bill payment and even cleaning (through a partner).

Meanwhile, Careem’s customers in Pakistan continue to face disappointing service levels, characterised by long waiting and oftentimes, outrageous fares. With acquisition done and the volumetric growth not as important to show to the investors, it was only a matter of time for the local market to take a back seat.

“If you look at the different markets in which Careem operates, Pakistan has received the maximum amount of investment at over $100m. When we came here, the building blocks weren’t there and we needed to heavily incentivise both demand and supply sides. But after the pandemic hit, the company couldn’t keep investing at the same pace, making the service expensive for many even though now it was at its fair price instead of the artificially low rates that were kept till then,” continues Mr Sheikha.

“Not everyone that was able to afford the service previously can afford now but we have to keep bringing more and more options to the market at different price points,” he says. So what can the customers expect from Careem? “We didn’t invest enough in the rickshaw category, which is the transport of choice in a city like Karachi for the vast majority and that will be one of the focus areas. There is also the motorbike where we need to double down on, then perhaps carpooling as well. The idea is to create a lot more options on the platform to choose from,” the founder comments.

In many ways, the company also fell prey to the predictable, yet unfortunate, macroeconomic cycles that Pakistan is used to. When they started out, the rupee was being kept at a pretty high level while the policy rate was one of the lowest in our history, giving way to a short boom that started unravelling by mid-2018. The after-effects of that are being felt to this day by everyone, and Careem is no exception. But that’s part and parcel of doing business here.

While it might no longer have a favourable economic environment (at least in Pakistan) or the dollars to quickly buy customers, there is one thing that Careem has managed to do which will stick around for much longer: build a culture that grooms some of the best resources in the industry. So much so that having the company name in your CV can help you not only command premium salaries elsewhere but also bag big funding rounds in case you are raising money as a founder.

Published in Dawn, The Business and Finance Weekly, November 1st, 2021

Dear visitor, the comments section is undergoing an overhaul and will return soon.