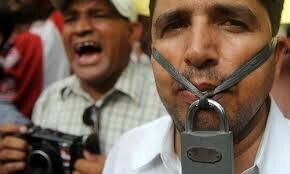

THE assault on savings of the salaried class continues unabated.

The recent ban on investment in National Savings Schemes (NSS) by retirement funds is the continuation of “land grab” that began in 2008. The Mutual Funds Association of Pakistan (MUFAP) and the Pakistan Stock Exchange (PSX) are glowing in triumph and exchanging felicitations. The cavalcade of ban advocates continues to avoid data, logic and context. Some new fluff under the banner of “international best practices” has been added to the clichés of yield curve and capital market development.

Let us assume that the term “international best practices” means drawing a parallel with the United States. It is an excellent benchmark since the United States is the bastion of capitalism and home to the world’s largest capital market.

America as yardstick

All US citizens are entitled to Social Security, which provides guaranteed inflation-adjusted lifelong income. The US government is taking 100 per cent of the investment risk, reinvestment risk, inflation risk and longevity risk. Workers with disability, widows and children are entitled under the programme. The scale and quantum of risk transfer from the US citizens to their government under Social Security will dwarf the cost of any put option that our government provides to the salaried class on NSS investments of Rs600 billion to Rs800bn through retirement funds.

To rail against NSS in the name of international best practices but ignore state pensions under the same framework is disingenuous

The bedrock of retirement funds is long-term sovereign bonds. They offer the highest real return after shares. The value of long-term bonds is extremely volatile i.e. the price of 10-year Pakistan Investment Bonds (PIBs) has fluctuated between 29pc and 34pc in the last 12 months. Stocks have higher volatility. Social Security eliminates the entire volatility of bonds, stocks and other assets by delivering a stable income in the post-retirement period.

Our government does not offer such pensions, but it absorbs the volatility of long-term PIBs through the provision of NSS in the pre-retirement stage. The ban will now force trustees to choose between the devil and the deep blue sea — either pursue higher real returns of 10-year PIBs but risk a significantly lower settlement to some employees upon retirement or avoid the volatility of long-term bonds altogether and reduce the accumulated savings by 16-32pc of all participants.

To harp on the absence of NSS under international best practices but ignore state pensions under the same framework is to be either ignorant or disingenuous.

The nibbling away

A little history now. The “land grab” began in 2008 when tax policy was first used to penalise provident funds (PFs) and support voluntary pension schemes (VPS). Today, the tax exemption for the employer’s contribution to the PF is capped at Rs150,000 but there is no such limit for his or her contribution to the VPS. A level playing field would enable employees to accumulate 20-25pc higher savings under PFs in comparison to VPS. PFs operate under a non-profit structure and cost significantly less.

Pakistan is perhaps the global exception where tax policy has been used to lower the savings of the public to benefit fund managers.

Another move to transfer business to mutual funds was through a draft SRO in February 2016 that banned the direct holding of listed shares by PFs. Investment in equity mutual funds thus became the only option for equity exposure. The annual cost of five large equity funds at the time was around 3pc. PFs sought a review. The Securities and Exchange Commission of Pakistan (SECP) soon convened a roundtable conference of all stakeholders to discuss the topic. Common sense prevailed. The SRO was withdrawn.

The path forward

Reform to protect and increase public savings is always welcome. There is indeed some low-hanging fruit on four fronts.

First, the immediate priority for the SECP should be to initiate the formation of a trade body like MUFAP that represents retirement funds and other non-profit organisations (NPOs). Financial services companies and connected parties cannot be members.

Second, tax incentives and investment rules for retirement funds and VPS should be identical. There is absolutely no logic to penalise PFs through tax and not allow VPS to invest in NSS. There is a dire need to streamline and stop leakages from PFs and VPS. The balance transfer rules between PFs and VPS should be the same.

Third, the standardisation of commission sharing and engagement contracts between distributors and mutual funds and insurance companies is critical. Once the SECP has registered an individual as a qualified distributor, it should be mandatory on each mutual fund and insurance company to open access to their platforms. This will encourage the participation of qualified professionals in financial advisory and distribution business and protect naïve investors.

Fourth, the undeserved fiscal benevolence that exclusively benefits the top 1pc should stop. The maximum annual contribution to avail tax credit in VPS equivalents in America is capped at $19,500. VPS has no such rupee limit.

Will the choir of international best practices sing on these topics?

A good step at this time would be to immediately make public the names of the committee members of the State Bank of Pakistan (SBP) that recommended the ban to the Ministry of Finance. At stake is the integrity of due process. Did retirement funds get a hearing? Did the committee include conflicted members i.e. brokers, mutual funds and their representative bodies? Staff from the Debt Management Office would also pose a conflict of interest as the accounting transfer of NSS debt to treasury bills and PIBs would show good performance.

Cautionary tales

The retirement disaster unfolding in Chile should be a flashing red light against thoughtless reform. Chile’s major reliance on individual saving accounts, a model championed by the World Bank during the 1980s, has been an unmitigated disaster. Savings pool and income of its retirees would be a lot higher had Chile pivoted to more successful retirement models, such as the ones implemented in the Netherlands and Canada.

Of course, the Dutch and the Canadian regulators would not allow a few AFPs (Chilean name for VPS) to ride roughshod over the savings of the public for almost four decades.

Economic renaissance in which industrialisation, trade and commerce flourish will always precede capital market development. Our collective effort should thus focus on the revival and resurgence of the real economy. Hasty greed of capital market participants is putting cart before the horse.

Social Security in the United States has also faced existential challenges from time to time. There have been attempts to privatise it based on concocted fears of fiscal sustainability. Paul Ryan, a libertarian and the 54th speaker of the House of Representatives, was the political cheerleader of this campaign. The privatisation bandwagon lost momentum when a conservative-leaning Federal Reserve chairman, Alan Greenspan, straightened the voodoo economics of Paul Ryan in a congressional testimony in 2005.

Such a forceful and unequivocal stand of the Fed chairman is an international example certainly worth emulating.

The writer is CEO of Magnus Investment Advisors. The article does not represent the views of the company.

Published in Dawn, The Business and Finance Weekly, July 20th, 2020