KARACHI: As the investors’ interest in equities sank to new lows, stocks continued the losing streak for fourth session in a row. The benchmark KSE-100 index opened in the red and remained on a slippery slope in both sessions on Friday, finishing with loss of 424.68 points (1.16 per cent) to settle at 36,122.95 - lowest since May 31, 2016.

Selling was observed across the board in the lead of heavyweight banking and exploration and production sectors. Investors’ concerns were mounting each passing day on the precarious health of economy, the hint of harsh budgetary measures that may be taken to meet the International Monetary Fund conditions for bailout package and the scare over what would be decreed by the upcoming budget.

Announcement of MSCI review scheduled on May 13, and the Financial Action Task Force review on the country’s compliance report further kept investors on tenterhooks. Adding fuel to the fire, speculations started to haunt investors on the political developments. Finally, the advent of Ramazan in a couple of days with reduced trade timings also discouraged participants from taking fresh positions.

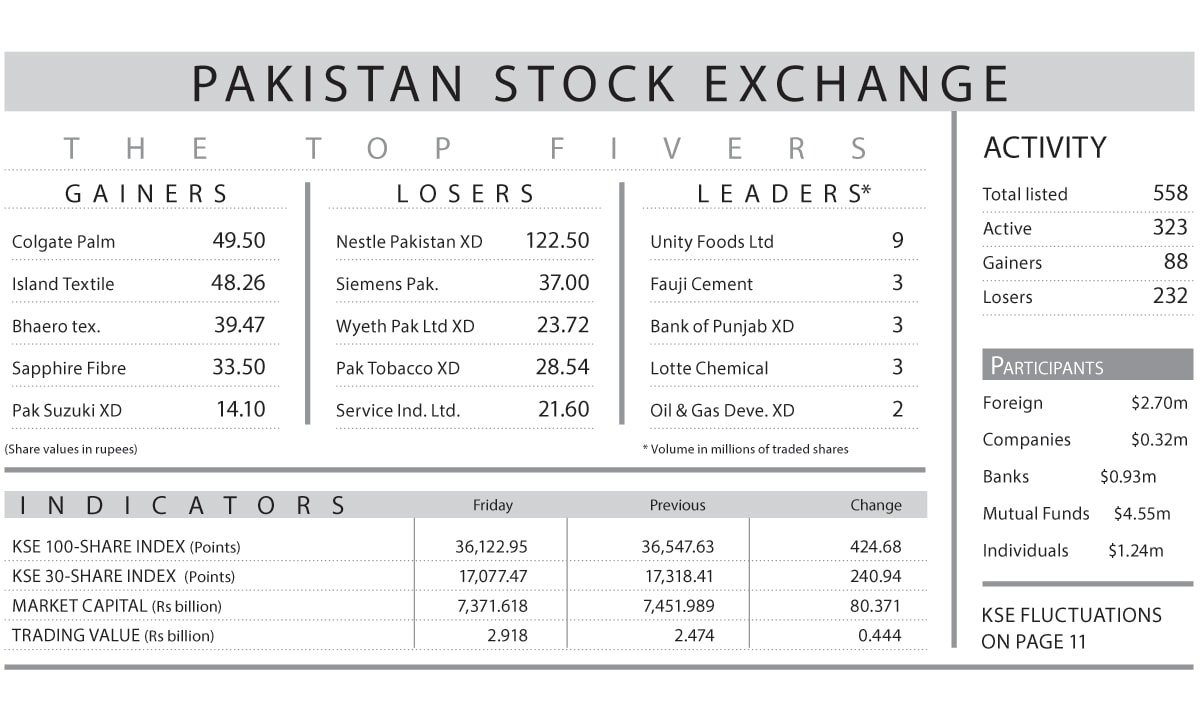

The volume remained low at 64 million shares, down 5pc over the previous day while traded value jumped by 18pc to reach Rs2.9bn. Stocks that contributed significantly included Unity Foods, Fauji Cement, Bank of Punjab, Lotte Chemical and Oil and Gas Development Company (OGDC), which formed 32pc of total volume.

Sector-wise, exploration and production was lead loser of 128 points on declining oil prices with the giant OGDC also coming under the hammer. Cement also closed on a weak note where major players such as Lucky, DG Khan, Pioneer and Fauji Cement closing in the red.

Among scrips, major contribution to the index downside came from Habib Bank, lower by 2.93pc, Pakistan Petroleum 2.74pc, Pakistan Oilfields 3.16pc, OGDC 1.71pc and Engro Corporation 1.49pc, taking away 211 points. On the flip side, Bank Al Habib, up 1.01pc, Pak Suzuki 5pc and Colgate-Palmolive Pakistan 2.54pc added 25 points.

Published in Dawn, May 4th, 2019

Dear visitor, the comments section is undergoing an overhaul and will return soon.