Mosquito bites swell up and itch. So do inflation bites. But when the political environment is charged, some describe this swelling and itching with exaggeration while others pretend as if there is no swelling or itching at all.

Let the facts speak for themselves.

In September 2017, annualised inflation measured by the Wholesale Price Index or WPI stood at 1.6 per cent: the number shot up to 9.2pc in September 2018. And before that, in July and August, the number was even higher — 10.5pc and 11pc, respectively. So it just moderated somewhat in September.

Aggregate demand is still high as the purchasing capacity of a segment of the population in the economy is still intact

In all likelihood, October data will not show much respite as the recent increase in gas prices may have a considerable impact on wholesale or ex-factory prices of locally produced items of agricultural, industrial and commercial use.

But why look at the WPI?

A sharper increase in the WPI often pushes up the Consumer Price Index (CPI), which measures overall inflation, and the Sensitive Price Index, which reflects inflation for the poor. Periodic deviations from this rule of thumb are possible and have even been recorded. But a sustained hike in the WPI for a considerable period — say, a full fiscal year — does not spare the CPI and SPI movement. Both are affected accordingly.

SPI inflation for the week ending on Oct 11 recorded an annualised increase of 6.52pc. Prices of 19 out of 53 essential items of daily use showed a rising trend. These include gas charges, LPG cylinders, cooking oil and vegetable ghee, chicken and eggs, wheat and wheat flour, Irri-6 and broken basmati rice, sugar, gur and red chillies etc.

People of least financial resources use these and similar items and are affected when their prices move up.

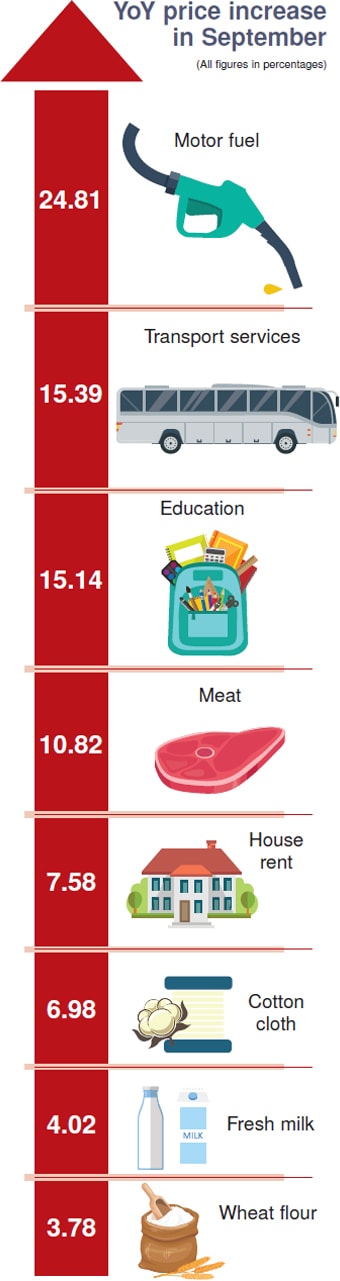

CPI inflation showed an average year-on-year increase of 5.12pc. In addition to the above-mentioned foodstuff, many more items in the CPI basket, including milk, meat and fish and pulses, depicted a rising trend.

Prices of other categories of items of daily use, like clothing and footwear, medicines and health facilities, home furnishing and household items, transport fares, communication charges and expenses on education and recreation, also showed an upward trend in September.

Depending on various factors, including how thick the subsidy cover on essential items is, WPI inflation sometimes hit SPI inflation less harshly. Similarly, if the nature of consumer inflation is demand-induced and demand for goods and services declines substantially, we can even see CPI inflation less affected by a preceding high WPI inflation.

A build-up in inflationary pressure became evident even before the close of the last fiscal year. That pressure is only growing since the beginning of the current fiscal year. A downward movement of a few basis points in a given month in one measure of inflation is not that important. What is important is that the current price lines are way above those from a year ago. The trend looks troubling indeed.

After increasing gas prices 10-143pc for different segments of users, the PTI government has postponed the electricity price hike for the time being. By withdrawing subsidies and increasing electricity prices, the cash-starved government can save hundreds of billions of rupees. Thus, the announcement of higher electricity charges cannot be withheld for long. Eventually, electricity prices will go up — and pretty soon. Minister for Information Fawad Chaudhry has already hinted at that.

What we see today is a combination of different kinds of inflationary pressures in the economy. Rupee depreciation and the imposition of regulatory duties on imported items are making imports costlier and contributing to what economists call imported inflation.

Higher interest rates aimed at stabilising the faltering rupee are adding up to the cost of production, thus leading to cost-push inflation. As the purchasing capacity of a segment of population that thrives on earnings not fully recorded in the economy is still intact, aggregate demand is still high. Along with the fact that our informal economy is large and containing the expansion in the currency in circulation is difficult, this is an impediment to harnessing demand-induced inflation. Hence, inflationary pressures are diverse and strong.

The Federal Board of Revenue (FBR) recently imposed 5-90pc regulatory duties on 570 categories of imported items to keep the trade deficit in check. Similar moves made in the past yielded some results in the first quarter of this fiscal year. But one can imagine how regulatory duties on such a vast range of imported items will impact the overall price levels.

Many of the items on which regulatory duties have been imposed are those that are not covered in our CPI. As such, their higher prices will not necessarily reflect in CPI inflation. But then the basket of goods and services for computing inflation is not very representative and needs restructuring.

From the central bank’s point of view, what is troubling on the inflation front is that core inflation has been showing a sharper increase since the beginning of this fiscal year. Core inflation, measured in terms of non-food, non-energy price movements, depicted a high year-on-year increase of 8pc in September this year against 5.4pc a year ago. Similarly trimmed core inflation — which is computed after excluding 20pc of the items showing extreme price changes in a month — showed a year-on-year rise of 5.8pc in September against 4.1pc a year ago.

The ongoing tight monetary policy can be expected to eventually bring down these numbers. But unless the root causes of inflation, like fiscal and external account imbalances, are addressed and unless the rupee makes a big recovery, keeping inflation in check is just too difficult. Much depends on global fuel oil prices that have been on the rise for the past one year. Brent crude weighted average price rose 39.1pc between Oct 19, 2017 and Oct 18 this year, according to daily oil market reports.

Published in Dawn, The Business and Finance Weekly, October 22nd, 2018