GUJRAT: The Federal Board of Revenue (FBR) and Gujrat Municipal Corporation (GtMC) have been at loggerheads for years over the issue of sales tax being deducted from contractors of uplift projects as the board has frozen the corporation’s bank accounts over alleged tax evasion of Rs5.6 million.

An official of the GtMC’s engineering branch told Dawn that they deducted sales tax while issuing payments to contractors against their bills in two categories: 7.5 per cent for filers and 10pc from non-filers.

However he said the FBR recently issued notices to the corporation to deposit the tax being deducted from contractors at 10pc across the board without distinction of a filer or non-filer. But the notices went unheeded since the corporation’s branch concerned had been engaged elsewhere.

Confirming the reports of a conflict between the institutions, the official added that the FBR had issued notices for depositing Rs5.6 million as per 10pc tax deduction, which the corporation could not comply with. This resulted in the attachment of the GtMC’s accounts in the main branch of Bank of Punjab.

Another source said the chief officer and finance officer of the corporation had approached the FBR’s Sialkot region officials on Friday last as these officials had prepared the response of the civic body over the tax deduction issue.

The difference in sales tax deposits was detected in a recently held audit of the development expenditures of the corporation due to which the notices were issued. The corporation could face problems in making payments if its bank accounts were not unfrozen.

A senior official of the GtMC claimed the matter would be resolved soon and there would be no issue in making payments.

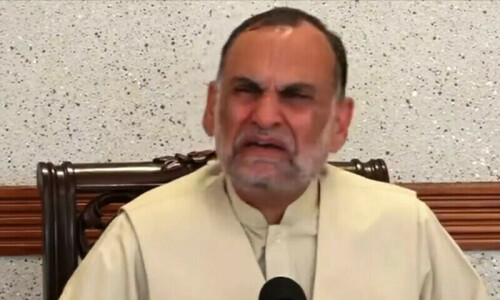

GtMC Mayor Haji Nasir Mehmood told Dawn that the issue dated back to the tehsil municipal administration days. The FBR issued notices saying the tax collection and subsequent deposits were less. “We have a hearing tomorrow (Tuesday) with the bureau’s Sialkot commissioner. We are ready to deposit the difference in tax they have pointed out, but we want our accounts unsealed as soon as possible,” he added.

Meanwhile, the regional authorities of FBR have launched an aggressive tax collection campaign in Gujrat city where teams were consistently conducting raids and issuing notices to traders and industries to meet revenue generation targets.

Published in Dawn, December 26th, 2017

Dear visitor, the comments section is undergoing an overhaul and will return soon.