This week in the last trading session, panic dollar buying forced the rupee to dive to its lowest level in almost four years.

A strengthening dollar against major currencies in overseas market in coming months could force the government to devalue the rupee. The IMF has already recommended rupee devaluation.

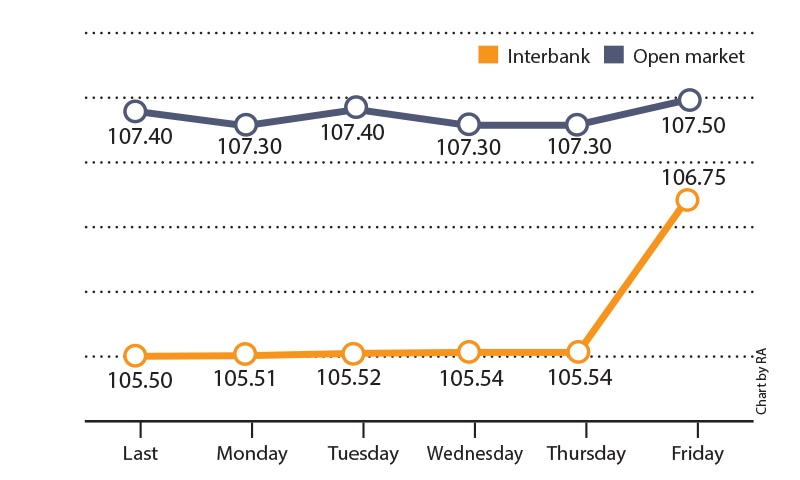

Meanwhile, last week on the interbank market, the rupee/dollar parity traded almost stable, hovering in the range of Rs105.51/52 and Rs105.54/55.

The dollar recorded an abrupt rise against the rupee on Friday after the rupee reportedly hit almost a four year low

Commencing the week in minus the rupee on Monday drifted against slightly lower at Rs105.51 and Rs105.52 against the last closing at Rs105.50 and Rs105.51.

On Tuesday, the dollar changed hands at Rs105.52 and Rs105.54 on slight pickup in dollar demand.

On Wednesday, the rupee extended its overnight weakness against the dollar while on Thursday the rupee further slipped to Rs105.54 and Rs105.55.

On Friday, however, the dollar recorded an abrupt rise against the rupee after the rupee reportedly hit almost a four year low, posting its biggest single day fall of in almost nine years on panic buying to meet oil import payments.

In the early session, the dollar at one stage rose as high as Rs109.50 but later settled at Rs106.75 and Rs107.25 towards the close of the session

In the open market, the rupee/dollar parity did not show much change last week.

The rupee commenced the week on a stable note as the parity traded flat at Rs107.30 and Rs107.50.

On Tuesday, however, the rupee turned negative against the dollar. The dollar climbed to Rs107.40 and Rs107.60.

The rupee was quick to recover its overnight losses against the dollar on Wednesday trading at Rs107.30 and Rs107.50.

The parity did not show any change on Thursday.

In line with interbank market, the demand for dollar unexpectedly rose significantly on panic dollar buying on Friday closing the week at Rs107.50 and Rs108.00.

Against euro the rupee showed a firm trend last week.

Commencing the week in plus, the rupee gained on Monday pushing the euro down to Rs126.60 and Rs127.85 from the previous week’s closing level of Rs126.75 and Rs128.00.

The euro staged an overnight recovery against the rupee on Tuesday trading at Rs126.80 and Rs128.05.

Staging a rebound on Wednesday, the rupee regained strength against the euro pushing euro lower at Rs126.30 and Rs127.55.

On Thursday it traded at Rs126.00 and Rs127.25 and the euro downslide against the rupee persisted on Friday, hitting almost a two-week highs at Rs125.60 and Rs126.85 towards the close of the week.

Published in Dawn, The Business and Finance Weekly, December 11th, 2017

Dear visitor, the comments section is undergoing an overhaul and will return soon.