In the local currency market, the rupee closed the week slightly depressed against the dollar on improved demand by importers and private sector’s buyers in the open market.

In the interbank market, where dollar demand and supply was almost in balance, the rupee managed to remain firm because of a forex influx and moderate demand.

In order to maintain sufficient market liquidity, the State Bank of Pakistan reportedly kept providing funds to cater to importers and corporate sector demand which kept the rupee slightly firm against the dollar in interbank dealings.

Experts foresee the dollar coming under pressure in the coming weeks in the open market due to influx of remittances ahead Ramadan.

In the interbank market, the rupee managed to remain firm because of a forex influx and moderate demand

On the interbank market, the rupee/dollar parity showed a firm trend, trading in a narrow band last week.

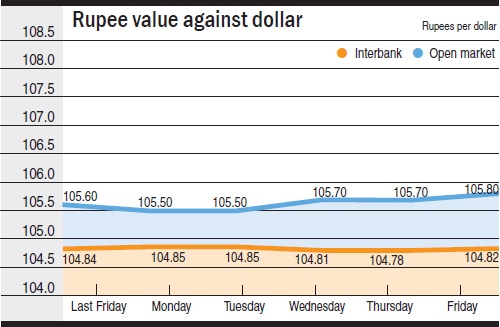

As the central bank continued to provide liquidity in the market, the rupee moved with modest gains against the dollar. It commenced the week in minus in the first trading session at Rs104.85 and Rs104.86 against the last closing at Rs104.84 and Rs104.85.

After gaining seven-paisa on the buying counter and six-paisa on the selling counter in the previous three consecutive sessions, the rupee turned negative towards the weekend as it failed to hold firm ground against the dollar in the last trading session.

The rupee posted four-paisa loss on the buying counter and another three-paisa loss on the selling counter before closing the week at Rs104.82 and Rs104.83 on slightly higher dollar demand.

During the week, the rupee on the interbank market still managed to appreciate against the dollar by two-paisa on week on week basis.

In the open market, the rupee traded firm against the dollar last week. The central bank’s decision to make sufficient liquidity available in the market to cater to importer demand kept the rupee firm against the dollar.

Extending previous week’s winning streak against the dollar, the rupee in the first trading session posted ten-paisa gain against the prior week. As a result, the rupee hit its highest level against the dollar in over six months at Rs105.50 and Rs105.70.

In the third trading session, however, the rupee lost its overnight firmness and tumbled to a week low at Rs105.70 and Rs105.90. The parity, however, did not show any change in the fourth trading session and continued to trade flat at Rs105.70 and Rs105.90 for the second consecutive day.

However, the dollar edged higher on the back of significant demand from corporate sector and importers in the last trading session after the rupee posted ten-paisa loss and hit a seven day low, touching Rs106 barrier.

At the close of the week, the rupee receded to Rs105.80 and Rs106.00, a level last seen on May 03.

Meanwhile, the euro slumped against the rupee amid mild fluctuations last week, hovering in narrow band between Rs114.50/Rs115.10 on the buying counter and Rs116.00/Rs116.60 on the selling counter.

Commencing the week in plus, the rupee posted 40paisa gain in the first trading session.

Continuing its upward march, the rupee extended its overnight firmness against the euro, picking up 35paisa in the second trading session. As a result, the euro descended to Rs114.75 and Rs116.25.

After gaining 100paisa in the first three sessions, the rupee failed to hold its previous week’s firmness.

The rupee closed the week on a negative note as it extended its overnight weakness against the euro for the second successive day, losing ten-paisa at Rs114.70 and Rs116.20 in the last trading session.

Published in Dawn, The Business and Finance Weekly, May 15th, 2017

Dear visitor, the comments section is undergoing an overhaul and will return soon.