THE World Bank’s recently released ‘Global Economic Prospects’ projects a picture of the Pakistan economy that is neither rosy nor bleak.

The economy will expand at an average annual modest rate of 5.4pc during 2016-18 in keeping with the 2015 (provisional) 5.1pc growth. For the same period (2016-18), fiscal deficit is likely to average 5.4pc of GDP just slightly better than 5.5pc for 2015 but representing a marked improvement over the 8.4pc level for FY13.

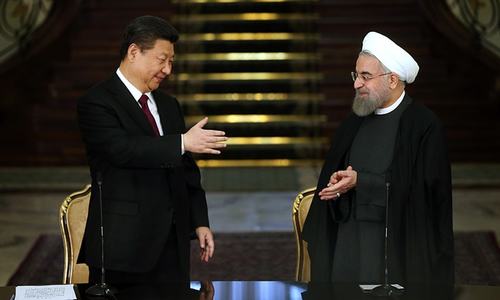

According to the World Bank report, Pakistan stands to benefit from three ‘tailwinds’ over the short- to medium-term.These are the China-Pakistan Economic Corridor (CPEC), the return of Iran to international economic community, and persistently low oil prices. The improving security situation, particularly in the commercial hub Karachi, will boost investor confidence and give impetus to growth.

It is imperative to achieve a broad agreement on how the CPEC would be implemented, otherwise a potentially beneficial project may prove counterproductive

At the same time, the multilateral donor warns of certain risks including high level of public debt — reaching 65pc of GDP —a substantial rise seen in public spending in view of 2018 national elections and a possible fall in remittances owing to economic slowdown in Gulf Cooperation Council (GCC) countries.

The implementation of the CPEC, and the outcome of government efforts to improve business climate and ease energy constraints will also bear upon how well or bad the economy performs.

Let’s evaluate some of the factors, identified by the World Bank, that may promote or inhibit the growth of the economy in short-to-medium term. Under the CPEC, which seeks to connect the Gwadar port with western China to facilitate China’s faster and comparatively economical access to the Gulf region, the Asian giant will inject $46bn into Pakistan, partly as investment and partly as credit. Out of this amount, $34bn will be spent on energy projects (mostly in the form of investment), while $12bn will go to infrastructure development (mostly in the form of credit) till 2030.

The CPEC investment is what the doctor orders for a country whose foreign direct investment inflows (FDI) have dried up over the years. In FY15, the country got meagre $852m FDI against $1.7bn a year earlier. In the first five months of this fiscal year (July-November), $540m FDI was received.

That said, there are couple of issues with the CPEC implementation. The foremost is the political risk. Before releasing billions of dollars for investment in another country, the donor sees how safe the recipient is for doing business with. A precarious security situation has been the country’s Achilles heel.

Though the security situation is improving, a lot of work needs to be done. Balochistan, where Gwadar is located, is a restive province.

The second issue is dispute over the corridor routes. Three routes have been envisaged. The western route starts from Burhan on the Peshawar-Islamabad motorway and after moving through DI Khan, Zhob, Quetta, Surab and Hoshab, ends at Gwadar.

The eastern route passes mainly through central Punjab and Sindh, while the central corridor will pass through Khyber-Pakhtunkhwa (KP), Punjab and Sindh.

There are two problems with the western route, whose major beneficiary would be KP and Balochistan. First, the en-route areas are relatively more underdeveloped and will need greater capital injection for development. Second, these areas are relatively more insecure.

Of late, the federal government has come under fire for allegedly being biased towards development of the eastern route at the expense of the western — a charge which Islamabad denies. Political parties based in KP and Balochistan have threatened to disrupt the CPEC execution in case their concerns are not addressed.

Whether these concerns are based on mere perception or reality is beside the point. The important thing is that a significant section of the polity has such perception. This makes it imperative to achieve a broad agreement on how the CPEC would be implemented otherwise a potentially beneficial project may prove counterproductive.

Persistently low oil prices are a doubled-edged sword, which cuts either way. Low oil prices mean comparatively low level of current account deficit as well as reduced cost of doing business, which will stimulate investment and growth. On the other hand, depression in energy prices has slowed down growth in GCC countries, which may adversely affect remittances from the Gulf region depressing consumer and investment demand at home.

The remittances also finance foreign trade deficit and provide a strong balance of payments support. In FY15, remittances reached $18.72bn compared with $5.49bn in FY07. Out of the $18.72bn, $12bn was remitted from the Gulf countries. Not only that, the Gulf states are important export markets for Pakistan.

In a related development, the removal of international sanctions on Iran opens up an important market for Pakistan’s exports. It may also further drive down world oil prices — good for our current account balance — and remove the biggest impediment to import of gas from Iran thus reducing energy shortage.

Email: hussainhzaidi@gmail.com

Published in Dawn, Business & Finance weekly, January 25th, 2016