LAHORE, June 18: The levy proposed on property and real estate in the 2013-14 budget will not only fetch additional Rs2 billion revenue but also encourage the construction sector in Punjab.

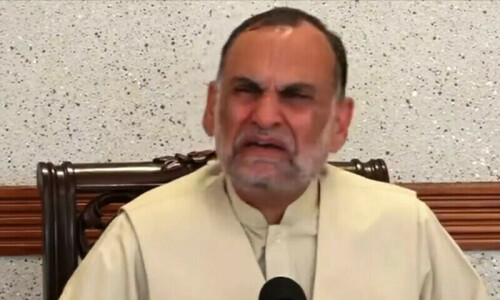

“More services have been brought into the General Sales Tax (GST) net while its rate has been maintained at 16 per cent,” said Punjab Minister for Finance Mujtaba Shujaur Rehman at the post-budget news conference on Tuesday.

Imposition of five per cent Capital Gain Tax would discourage artificial price hike in the real estate sector. “In fact, no tax has been proposed on people buying or selling property after five years as such lot is not involved in gambling or speculation in the real estate sector,” said the minister who was accompanied by Minister for Law Rana Sanaullah, Finance Secretary Tariq Bajwa and MPA Dr Aaisha Ghaus Pasha. Terming the levy of one-time Rs500,000 to Rs1.5 million tax on big houses a luxury tax, both Mr Rehman and Rana Sana said it was not discriminatory. The tax has been imposed on A-category houses and Lahore has maximum number of such holdings. “The PML-N has biggest vote bank in Lahore and won most seats from here,” said Mr Rehman.

Secretary Bajwa said the tax would be imposed on big houses that fell in A-category residential areas in Lahore, Multan, Faisalabad and Rawalpindi only.

Rana Sana said two years ago heavy taxes were imposed on luxury vehicles. Instead of paying the levy, people started getting such vehicles registered in Islamabad or other provinces. “The proposed levy reflects the vision of Chief Minister Shahbaz Sharif to make the rich pay taxes that could be utilised for social development,” he said.

Regarding the 10 per cent increase in salaries and pension against 15 per cent of Sindh and KPK governments, the finance secretary said Punjab had always followed the federal government.

The finance minister said minimum wages would gradually be increased to Rs15,000 as promised in the election manifesto of the PML-N.

Both ministers put the blame on electricity loadshedding when asked as to how the government would ensure implementation of the new minimum wages as the private sector was not paying the previously fixed Rs9,000 minimum wages.

Mr Rehman said the focus of allocation had been on education, health and southern Punjab. A sum of Rs244 billion or 26 per cent of the total budget, had been allocated for education, Rs102 billion for health sector and Rs93 billion of the Annual Development Plan for southern Punjab development schemes.

The finance minister said the Punjab government had allocated substantial resources for energy sector during the last two budgets. However, the then federal government created hurdles in execution of 50 to 200 megawatt projects.

Dear visitor, the comments section is undergoing an overhaul and will return soon.