Pakistan’s coalition government is expected to lay out ambitious fiscal targets in the 2024/2025 (July-June) budget on Wednesday that will help strengthen its case for a new bailout deal with the International Monetary Fund (IMF), officials and analysts said.

Pakistan is in talks with the IMF for a loan estimated to be anything between $6 billion to $8 billion to avert a default for an economy that is growing at the slowest pace in the region.

“The budget holds critical significance for Pakistan’s IMF programme and must close the gap between our revenue collection and total expenditure; it is thus likely be contractionary,” said Ali Hasanain, head of the economics department at the Lahore University of Management Sciences.

Pakistan narrowly averted a default last summer thanks to a short-term IMF bailout of $3 billion over nine months.

While its fiscal and external deficits have been brought under control, it came at the expense of a sharp drop in growth and industrial activity as well as high inflation, which averaged close to 30 per cent in the last financial year and 24.52pc over the last 11 months.

The growth target for the upcoming year is expected to be higher at 3.6pc compared to 2pc this year and economic contraction last year.

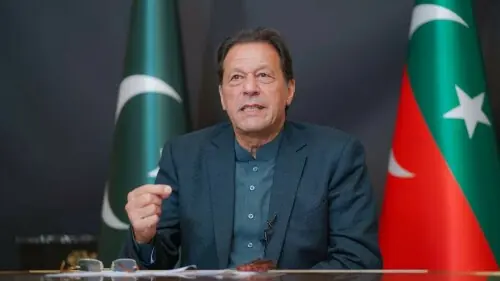

Prime Minister Shehbaz Sharif has expressed public commitment to tough reforms since being elected in February elections, but high prices, unemployment and a lack of new job opportunities have piled political pressure on his coalition government.

Standard Chartered said in a note on the budget last month that fully implementing all the measures that the IMF is likely prescribing, such as increasing revenue through widening the tax base and power tariff hikes, will be tough for Sharif’s government.

“A weak coalition government, a vocal and popular opposition, and the difficulty of implementing deep-rooted structural reforms were seen as reasons for caution,” Standard Chartered said in the note.

“A key concern among local stakeholders was the risk that front-loading tough fiscal measures could face a backlash from the public,” it added.

It will also be the first test for new Finance Minister Muhammad Aurangzeb, formerly the chief of HBL, Pakistan’s largest bank, who was brought in by Sharif to formulate fresh policy solutions to address persistent problems in the $350 billion economy.

Previous finance ministers have shied away from thorny steps like cutting subsidies, reducing government spending and increasing tax revenues from politically sensitive sectors such as real estate, agriculture and retail.

Mustafa Pasha, chief investment officer at Lakson Investments, said he believes taking such steps would be difficult.

“Any attempt to tax agriculture, retail and real estate will likely be poorly structured and face legal challenges which will prevent any collection,” he said, although he added that failure to address IMF demands would likely lead to a delay in a new programme which Pakistan cannot afford for long.

Another key point to look out for in the budget will be targets set for proceeds from privatisation. Pakistan is looking to make its first major sale in nearly two decades as it sells a stake in its national airline.

It is expected to be the first in a series of sales of loss-making entities, particularly in the troubled power sector.