KARACHI: Bearish sentiments persisted in the stock market for the fifth consecutive session mainly due to pre-poll uncertainty which dragged the benchmark KSE-100 index below the 64,000-point level on Wednesday.

Topline Securities Ltd said equities moved in both directions. Initially, the index made an intraday high at 64,551 ( a gain of 380.37 points). However, profit-taking at the aforesaid level wiped out early gains. It witnessed an intraday low at 63,874 levels (a loss of 297 points).

Investors chose to do profit-taking in selective stocks of banks and fertiliser sectors in the backdrop of increasing political noise and the absence of any positive triggers.

Resultantly, Meezan Bank Ltd, Engro Corporation, Bank Al Habib, Engro Fertiliser Ltd and United Bank Ltd cumulatively contributed 182 points to the index fall. On the flip side, Pakistan Tobacco, Pakistan Petroleum Ltd and Indus Motor collectively added 75 points.

Ahsan Mehanti of Arif Habib Corporation said mid-session support was witnessed on upbeat data for home remittances rising 13pc year-on-year to $2.4 billion in December 2023 and a surge in global crude oil prices, which helped trim some losses.

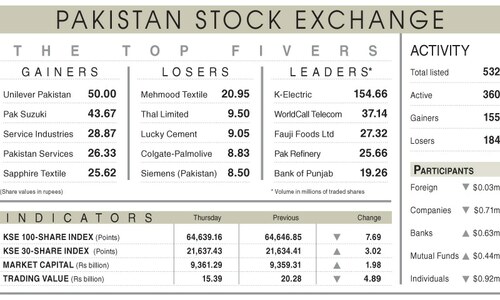

The KSE-100 index closed at 63,919.85 points after losing 250.73 points or 0.39 per cent from the preceding session.

The overall trading volume surged by 41.68pc to 636.16 million shares. The traded value also rose 46.40pc to Rs17.98bn on a day-on-day basis.

Stocks contributing significantly to the traded volume included K-Electric Ltd (151.24m shares), Hascol Petroleum Ltd (67.98m shares), Worldcall Telecom Ltd (42.06), Pakistan Refinery Ltd (34.99m shares) and Pakistan International Airlines Corporation (29.33m shares).

Companies registering the biggest increases in their share prices in absolute terms were Pakistan Tobacco Company Ltd (Rs79.00), Pak Suzuki Motor Company Ltd (Rs58.32), Indus Motor Company Ltd (Rs48.22), Bata Pakistan Ltd (Rs37.66) and Exide Pakistan Ltd (Rs30.69).

Companies registering the biggest decreases in their share prices in absolute terms were Rafhan Maize Products Company Ltd (Rs448.00), Hoechst Pakistan Ltd (Rs40.80), Khairpur Sugar Mills Ltd Pakistan (Rs36.50), JDW Sugar Mills Ltd (Rs29.93) and Faisal Spinning Mills Ltd (Rs16.97).

Foreign investors were net buyers as they picked shares worth $0.29m.

Published in Dawn, January 11th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.