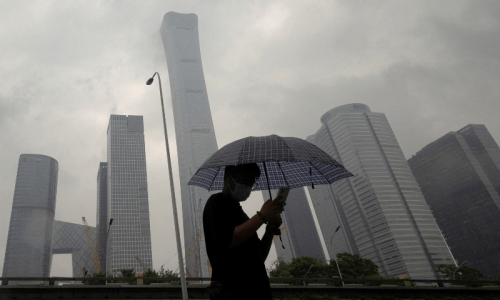

BEIJING: President Xi Jinping said that China’s economic recovery is “still at a critical stage”, state broadcaster CCTV reported on Friday, as sluggish domestic activity and property sector woes drag on a post-pandemic rebound.

The world’s second-largest economy expanded a moderate 4.9 per cent in the third quarter, slightly less than Beijing’s five per cent target, which is one of the lowest in years.

“At present, the country’s economic recovery is still at a critical stage,” Xi said at a meeting of China’s Communist Party Politburo, the country’s top decision-making body, according to CCTV.

Xi urged measures to boost the economy, saying that “the development situation facing the country is complex, with increasing adverse factors in the international political and economic environment”.

“It is necessary to focus on accelerating the construction of a modern industrial system, expand domestic demand, (and) prevent and defuse risks,” said Xi.

Xi also emphasised the need to shore up “self-reliance” in key science and technology sectors, and to “accelerate the construction of a new development layout”.

Officials have struggled to sustain a recovery from the impact of the Covid pandemic, even after removing draconian containment measures at the end of 2022.

Exports rose in November for the first time in seven months, officials announced Thursday, although the reading compares with a low base from last year when the impact of Covid policies were being felt the most.

Chinese exports — long a key growth driver — had largely been in decline since last October except for a short-lived rebound in March and April.

A surprise drop in imports in November highlighted weak consumer activity at home.

Downgraded to negative

Ratings agency Moody’s on Tuesday downgraded the outlook on the country’s credit rating to negative from stable, citing “broad downside risks to China’s fiscal, economic and institutional strength”.

Beijing’s finance ministry said in response it was “disappointed with Moody’s decision”, adding that such concerns about China’s economy were “unnecessary”.

But woes in the property sector — another traditional engine of growth — have exacerbated worries.

China’s vast real estate sector is mired in a deep debt crisis, with some of the nation’s biggest developers owing hundreds of billions of dollars and facing going out of business.

Authorities are on edge as debt fears stoke buyer mistrust, send home prices plummeting and, crucially, threaten to infect other sectors.

Construction and real estate account for around a quarter of China’s gross domestic product.

Ting Lu, chief China economist at Japanese bank Nomura, said Thursday that property woes remained “the single largest drag affecting China’s economy”.

“Despite the multitude of stimulus measures announced recently, we believe it is still too early to call the bottom,” he said in a note.

Published in Dawn, December 9th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.