KARACHI: The benchmark of the Pakistan Stock Exchange inched up on Wednesday on encouraging earnings announcements.

Topline Securities Ltd said the bullish sentiment, which was influenced by the corporate results especially in the banking sector, played a significant role in creating positive vibes in the stock market.

Investors exercised some caution in anticipation of the forthcoming announcement of the central bank’s policy rate decision, which is scheduled for next week.

Furthermore, market participants were closely observing the impending evaluation of the Stand-By Arrangement (SBA) by the International Monetary Fund.

Key sectors that contributed to the index rise were banking, oil and gas, technology and communication and cement.

According to Arif Habib Ltd, the stock market looks “heavy” and is, therefore, failing to hold its highs.

The KSE-100 index remains in a short-term range of 50,500- 51,500 points. “Breaking below 50,500 points will set up opportunities to reload for the move through 53,000 points,” it added.

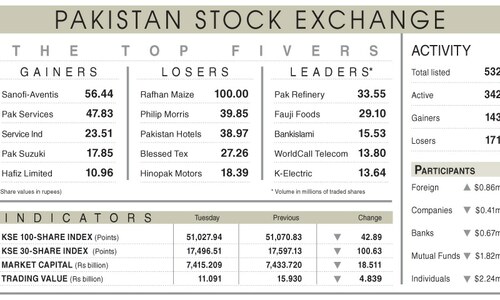

As a result, the KSE-100 index closed at 51,177.13 points after gaining 149.19 points or 0.29 per cent from the preceding session.

The overall trading volume increased 32.9pc to 427.4 million shares. The traded value increased 39.8pc to Rs15.5bn on a day-on-day basis.

Stocks contributing significantly to the traded volume included Pakistan WorldCall Telecom Ltd (80.7m shares), the Bank of Punjab Ltd (22.4m shares), Fauji Cement Ltd (21.2m shares), Oil and Gas Development Company Ltd (13.9m shares) and K-Electric Ltd (13.2m shares).

Companies registering the biggest increases in their share prices in absolute terms were Nestle Pakistan Ltd (Rs100), Sanofi-Aventis Pakistan Ltd (Rs60.67), Pakistan Tobacco Company Ltd (Rs39.96), Philip Morris Pakistan Ltd (Rs36.87) and Bata Pakistan Ltd (Rs31).

Companies registering the biggest declines in their share prices in absolute terms were Unilever Pakistan Foods Ltd (Rs1,000), Bhanero Textile Mills Ltd (Rs34), Mari Petroleum Company Ltd (Rs32.85), Pakistan Hotels Developers Ltd (Rs30.56) and Reliance Cotton Spinning Mills Ltd (Rs20).

Foreign investors were net sellers as they offloaded shares worth $4.28m.

Published in Dawn, October 26th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.