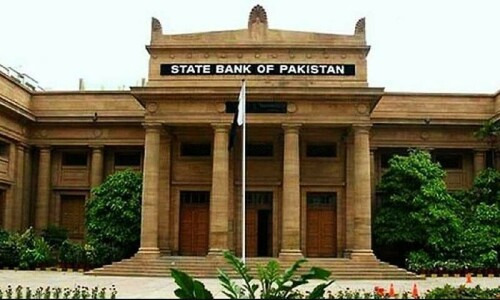

KARACHI: Pakistani currency depreciated by an unprecedented 28 per cent in the outgoing fiscal year, suggesting the strategy adopted by the State Bank of Pakistan (SBP) to manage the exchange rate proved fruitless amid a persistent political and economic crisis.

The drying up of inflows and dwindling foreign exchange reserves aided the US dollar’s upsurge against the rupee.

The greenback was available at Rs204.85 on June 30, 2022 since then it started rising sharply destroying the confidence of PKR.

On 27 June, the last working day of FY23, the dollar was priced at Rs285.99 in the interbank after hitting an all-time high at Rs298.93 on May 11.

Throughout the entire fiscal year, the country had to face an acute shortage of dollars which forced the economic managers to slash imports drastically to reduce the trade and current account deficits but this has slowed down the overall economy.

The government’s last estimate for economic growth was 0.29pc for FY23 compared to 6.1pc in FY22.

Fulfiling the conditions of the International Monetary Fund (IMF), the government took several measures including free float of the exchange rate which eroded the value of the local currency but, at the same time, the lack of inflows and the Fund’s reluctance to release the $1.1 billion tranche under the 9th review created severe shortages of dollars which pushed up its prices to new peaks.

The loan programme expires on June 30 but the government is still busy convincing the IMF and imposed Rs215bn in new taxes to reduce the revenue gap for FY24 and lifted the interest rate by another 100 basis points to 22pc as last ditch effort.

This high-interest rate has practically reduced demand for dollars in the open market as its price eased to Rs289-291 on Tuesday after touching a peak of Rs313 on May 30. People now prefer to keep money in banks to earn higher returns.

However, slow dollar demand in the open market was mainly an outcome of SBP’s decision that allowed banks to purchase dollars from interbank for international credit card payments.

On June 23, the State Bank also lifted import restrictions imposed on Dec 2022.

Economists believe the expected release of the IMF tranche would not bring any big change since the poor economic performance has many dimensions like falling remittances, exports, a negative growth of Large-Scale Manufacturing and a still unclear political situation.

The government has already lost $7.2bn due to the contraction of remittances and exports during the first 11 months of FY23.

Published in Dawn, June 29th, 2023