Remittances sent home by overseas Pakistani workers and diaspora have the potential to increase to up to $50 billion if the money transfers through the illegal Hawala/Hundi operations are plugged.

The money transfer market operators estimate the illicit global remittance trade size to be up to 80 per cent of the legitimate transactions of $700bn.

“It means the actual global remittance market is almost twice the size of the legal trade. It also means that the illicit remittance trade is an international phenomenon, making it difficult for a single country to tackle in its entirety. The same is the case with Pakistan,” argues Naqqash Hafiz, the executive head of Ace Money Transfer — a company based in England.

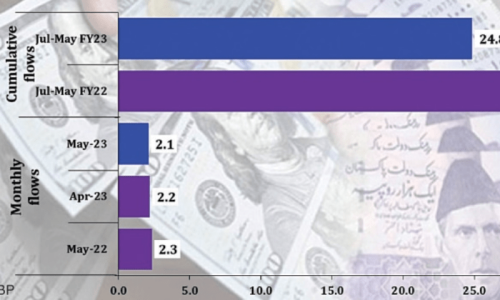

Remittances rose dramatically by over 35pc from $23.1bn in FY20 to a peak of $31.3bn in FY22. However, the ongoing fiscal year has seen a big drop, with the country losing $3.7bn in remittances in the first 11 months to May. The inflows have tumbled by almost 13pc to $24.8bn from $28.5bn a year ago.

The lost amount is more than three times greater than the International Monetary Fund (IMF) tranche of $1.2bn Islamabad has been struggling to secure for the last seven months. In the last couple of decades, remittances, which have dwarfed Pakistan’s annual export earnings over the last several years, have supported the nation’s external account in the face of drying foreign assistance.

The amount lost in remittances over the last year is three times greater than the IMF tranche of $1.2bn that the government is struggling to secure

The government, faced with a severe balance of payments crisis that has brought the country to the brink of a sovereign default due to the uncertainty surrounding the restoration of the suspended $6.7bn funding programme with the IMF, is targeting $33bn in remittances during the next fiscal year, according to its budget FY24 documents. Many contend that the target is unrealistic, given the economic and political turmoil and growth in the grey foreign exchange market.

According to him, Karachi is one of the four cities across the world, along with Cape Town and Dubai, closely linked with the global Hundi/Hawala trade networks. Large networks operate from Karachi. In most places, even in Europe, the majority of people associated with legal money transfer markets are Pakistanis, followed by Indians, Bangladeshis and others.

“It is not surprising if a huge part of foreign exchange earnings of the overseas Pakistanis doesn’t reach Pakistan and is diverted to other destinations by Hundi/Hawala operators,” argues Mr Hafiz, a trained chartered accountant who oversees such areas as finance, treasury, human resources, marketing and sales at the company.

The growing gap between the official interbank exchange rate and the grey market, which recently surged to over Rs20 a dollar, is believed to have encouraged overseas Pakistanis to choose illegal channels to remit cash for family support and investments.

“Remittances are down significantly, and especially in the last four to five months, due to a large gap between the interbank and open market rates. It has made a lot of difference. When you can get a premium of Rs15-20 against a dollar, you will not use legal money transfer channels.

“This is not the only reason, but it is one of the most important reasons. There is enough evidence to suggest that now this gap is influencing even those who used to send money via legal channels,” Mr Hafiz insists during an interview with this correspondent. Furthermore, he points out, import curbs imposed by the government to slow down dollar outflows to protect the meagre reserves and the growing under-invoicing of imports by traders is creating a massive demand for dollars in the market.

“The State Bank of Pakistan’s (SBP) decision to allow traders to arrange dollars for imports further pushed this demand as the importers rushed towards the grey market. Now the traders purchase the required dollars from the Hawala/Hundi operators in Dubai at a significant premium for import payments. These dollars never reach Pakistan or become part of the central bank’s reserves,” he adds.

He explains that consistent currency devaluation is yet another important reason for slumping remittances. “Many overseas Pakistanis send money for investment in property, in stocks, etc. They have suffered huge losses owing to currency devaluation in the last year.

“They may have made handsome profits in rupees but are accruing losses when converting the cash to remit it back. A good number of Pakistanis living abroad send cash to Pakistan to invest and make a profit to improve their living standards. If they cannot make profits, what’s the use of investing here? This shakes their confidence,” he says.

Other factors leading to a drop in remittances are poor financial conditions in the US and Europe. “The cost of living is surging in ‘host’ countries across the world, inflation is soaring, rents are increasing, and jobs are being lost owing to the bad economy. The disposable income of Pakistanis living abroad is shrinking. This is also an important factor behind falling remittances,” he insists.

“On top of that, overall financial and political instability in Pakistan is also keeping them from sending their savings to Pakistan. Our offices in England and elsewhere have received more than 1,000 calls in the last month about the rumours about the government’s plans to freeze private foreign currency accounts. In such uncertain times, the slump in remittances is but natural.”

He didn’t say it in so many words but implied that slumping remittances also had a lot to do with the change in the government in the country.

“We know that Pakistani workers and diaspora supporting a particular party, especially its leader, were driven by their political views to ‘help’ Pakistan, which spurred a hefty growth in remittances in the last two financial years. Now we see that drive waning. The political change definitely has affected.”

Though it may not be possible for Pakistan to attract the entire earnings of its migrant workers into its economy through legitimate channels, it can make efforts and launch awareness campaigns and reward schemes to encourage them to stop using the risky illicit routes for their own benefit.

Ace Money has joined Bank Al Habib to promote legal money transfer in an initiative backed by the SBP’s Pakistan Remittance Initiative (PRI). “We’ve initiated a cash reward drive to incentivise transfers through Bank Al Habib. The government needs to improve the environment to increase remittances and launch initiatives such as Roshan Digital Accounts to encourage investments by overseas Pakistanis in their home country.

“Besides, the people should be made aware of all the risks associated with the criminal activity of illicit foreign exchange trade. It can land both the operators and senders in trouble.”

He is hopeful that remittances will increase next year — though they will remain short of the target — due to the increased migration of workers to the Middle East countries and the UK last year.

“Migration and remittances correlate. Last year, about 11.3 million Pakistanis went abroad for work. That will have a positive impact on the size of remittances sent home.”

Published in Dawn, The Business and Finance Weekly, June 19th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.