ISLAMABAD: While concluding a public hearing on K-Electric’s Rs484 billion investment plan for the next seven years, the National Electric Power Regulatory Authority (Nepra) on Wednesday said it would review the performance outcome of its previous similar plan of Rs200bn before allowing it over the next two months.

During the hearing presided over by Nepra chairman Tauseef H. Farooqui, some interveners also raised questions over the investment plan saying KE’s past performance was the key reason behind no progress on the privatisation of the country’s other distribution companies (Discos). The KE’s future investment plan beginning July 2023 would stretch until June 2030.

Responding to a question about the previous seven-year investment plan, KE’s management team led by Moonis Alvi reported that the private utility had invested about Rs225bn against Rs200bn approved by the regulator.

Member Balochistan Mathar Rana asked the utility to provide full details as the regulator would examine its implementation and outcomes before clearing the new plan.

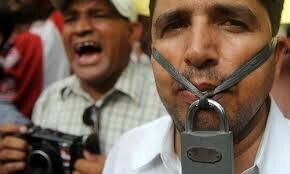

Jamaat Islami’s Hafiz Naeem demanded that the regulator should also verify if the Rs362bn investment commitment made by KE in 2009 had been honoured and with what results. He wondered how the regulator could allow such a big investment plan for the next seven years to a company which was already a defaulter.

Mr Farooqui enquired who would then ensure power supply to Karachi if the KE’s investments are not allowed. Mr Naeem said the regulator should pose such questions to itself because it was the job of the regulator to ensure power supply through competition or some other arrangement.

Interveners also pointed out that KE’s plan did not entail an increase in its generation capacity and rather banked on partnerships and purchases from others, the Nepra chairman said the regulator was ready to listen to any argument or arrangement for handing over generation part to the government.

Nepra members also raised questions over dollar-based indexation for returns on investments. Mathar Rana said Nepra had previously facilitated dollarisation of the power sector by allowing dollar-based indexations for power purchases from Independent Power Producers — the major factor behind the increase in energy costs. He indicated the regulator would have to look into the issue.

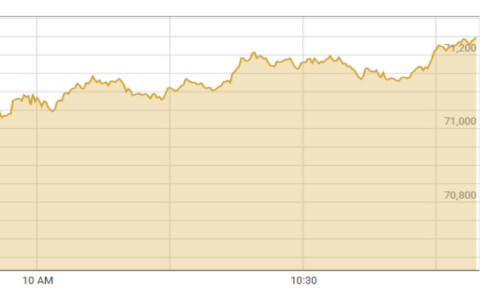

In its briefing, the KE’s team said its Rs484bn investment plan would ensure that 95pc of Karachi city becomes load-shedding free by 2030 from about 75pc at present. The investment will help bring down transmission and distribution losses to 12.8pc from 15.3pc at present. Since privatisation, KE has brought its T&D losses down from 34.2pc to 15.3pc in 2022, it said.

As per the plan, the company envisaged an investment of Rs280.915bn for expansion and improvement of the transmission system, about Rs185bn for distribution system improvement and expansion and about Rs18bn for safety, security and smart technology improvement.

KE’s CEO Alvi said the investment plan was conceived based on imminent changes in the power sector such as the liberalisation of the market and his company was embracing competition and had already filed for a non-exclusive distribution licence.

He said the main objective was to maintain a balance between affordability, availability and sustainability of power supply – the power sector’s current trilemma.

Moin Fudda, chairman of the board of directors of Central Depository Company (CDC) and chartered accountant by profession, wondered how the company would be able to invest Rs484bn while facing its legacy challenges and pointed out that its Rs400bn receivable claims would have to be brought to a closure. He said the Planning Commission and PM’s Taskforce on energy should pay attention to the matter.

Published in Dawn, March 2nd, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.