KARACHI: Pakistan should seek forgiveness of principal and interest on the debt extended by China, the Paris Club and bilateral and multilateral lenders, said the Pakistan Business Council (PBC) on Friday.

In its detailed proposals for improving the country’s external and fiscal accounts, the advocacy body of Pakistan’s largest private-sector businesses said Islamabad should obtain professional advice from sovereign debt advisers on restructuring and extending the debt payment terms as well as the cost of servicing it.

It acknowledged that the ongoing loan programme by the International Monetary Fund (IMF) “will not be sufficient” to meet debt obligations unless the same are “significantly restructured”. Short-term rollovers will not suffice, it said.

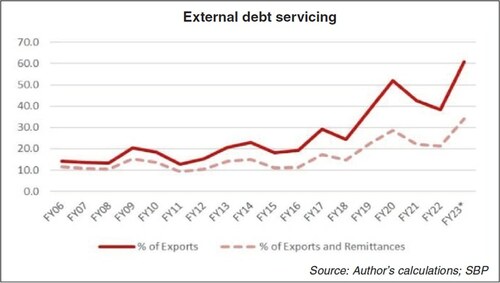

Pakistan’s external debt servicing obligation for 2022-23 is $23bn. About $6bn has been repaid while $4bn has been rolled over, which leaves the country with a yet-to-be-funded gap of $13bn.

The PBC called for the renegotiation of the 7th National Finance Commission Award, which is the formula that allocates financial resources among the federal and provincial governments.

The current award tilts heavily towards the provinces, leaving the central government with little fiscal space after debt servicing and defence spending every year.

The estimated impact of several measures proposed by the PBC on the external account is between $15.7bn and $18.9bn. The likely benefit of the proposals for the fiscal account is to the tune of Rs1 trillion.

The PBC suggests the government should focus on increasing the export of services like IT because of the ongoing contraction in global demand for traditional goods such as textiles.

Offering rebates to IT developers will encourage them to remit foreign exchange earnings via official channels — a move that’ll create additional inflows of about $2.5bn a year.

The PBC recommended that narrowing the spread between the informal and official dollar rates will stem the decline in remittances to the tune of $350 million a month or $4.2bn a year.

The government should revise the rates of return on dollar-denominated Naya Pakistan Certificates in line with interest rates globally to help retain current deposits and attract new deposits, it said.

The estimated net inflows under this head are $500m.

Expediting the sale of re-gasified liquefied natural gas (RLNG) power plants will generate $3bn. The PBC also called for limiting travel for Hajj, Umrah and pilgrimages to Iran, Iraq and Syria to save an estimated $1bn.

Moreover, non-resident Pakistanis should be made to use their foreign exchange savings abroad to buy air tickets, it noted.

The PBC called for barring non-tax filers from using Pakistan-issued credit cards to buy goods and services in a foreign currency.

The PBC urged the government to maximise the use of variable renewable energy — hydel, wind, solar and nuclear — as well as indigenous coal instead of imported fuels like furnace oil, RLNG and foreign coal.

“Complete reliance on indigenous sources would save $4.7bn annually, but result in a daily average shutdown of eight hours (with a seasonal variation of 4-10 hours),” it added.

The PBC recommended that the government should reduce the number of working days in a week to four with one-day work-from-home. This measure, along with early market closures, will cut down electricity demand by 10 per cent while curtailing petroleum demand by 10-12pc.

The central bank previously estimated an annual saving of $1.5bn-$2.7bn from such measures.

The PBC suggested the government should consider alternate-day use of even- and odd-numbered cars, but not motorcycles, to reduce fuel imports.

The PBC called for increasing the petroleum development levy on diesel to Rs50 per litre from Rs32.50 per litre to generate incremental Rs78bn in the next six months.

It also demanded a 10pc sales tax on petroleum products to raise Rs203bn in the remainder of 2022-23.

Published in Dawn, january 7th, 2023