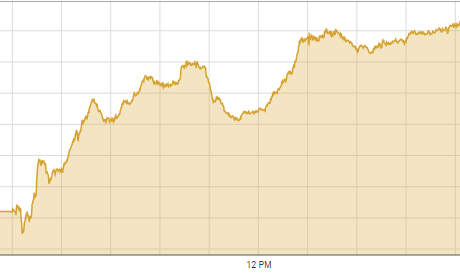

KARACHI: Shares inched up on Friday as investors welcomed the progress on the long-awaited review of the loan programme by the International Monetary Fund (IMF).

Topline Securities said the upward movement in share prices was witnessed in the second half of trading, thanks to the IMF chief’s reported assurance to the premier that the lender’s team will soon visit Pakistan for the review.

Arif Habib Ltd said volumes climbed significantly across the board. Major activity was recorded in refining and exploration and production sectors in anticipation of the circular debt’s resolution in the gas sector. Stock prices also rose ahead of the earnings season that’ll soon begin on the bourse.

As a result, the KSE-100 index settled at 41,007.52 points, up 290.78 points or 0.71 per cent from the preceding session.

The overall trading volume increased 62.8pc to 182 million shares. The traded value went up 119.5pc to $29.9m on a day-on-day basis.

Stocks contributing significantly to the traded volume included Cnergyico PK Ltd (27.9m shares), K-Electric Ltd (17.6m shares), Pakistan Refinery Ltd (16m shares), Pakistan Petroleum Ltd (10.5m shares) and WorldCall Telecom Ltd (8.1m shares).

Sectors contributing the most to the index performance were exploration and production (118 points), technology and communication (81 points), miscellaneous (64.9 points), fertiliser (62.3 points) and investment banking (35.4 points).

Companies registering the biggest increases in their share prices in absolute terms were Pakistan Services Ltd (Rs130), Premium Textile Mills Ltd (Rs44.01), Shield Corporation Ltd (Rs19.65), Attock Refinery Ltd (Rs11.03) and National Refinery Ltd (Rs10.66).

Companies that recorded the biggest declines in their share prices in absolute terms were Nestle Pakistan Ltd (Rs209.90), Sapphire Fibres Ltd (Rs101.07), Mari Petroleum Company Ltd (Rs25.43), Siemens Pakistan Engineering Ltd (Rs20) and Gadoon Textile Mills Ltd (Rs18.75).

Foreign investors were net buyers as they purchased shares worth $0.05m.

Published in Dawn, january 7th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.