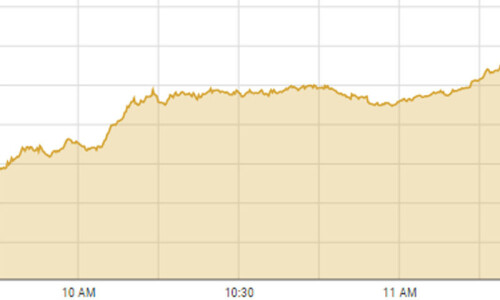

KARACHI: Share prices oscillated within a narrow range on Wednesday before closing on a slightly higher level on the back of unfavourable economic sentiments and political instability.

Arif Habib Ltd said investors remained on the sidelines even though the exploration and production sector caught the limelight on expectations about a gas price hike.

Buying interest in selected blue-chip stocks helped the benchmark index make gains over the preceding close in spite of the broader market failing to generate notable volumes, said JS Global. “Investors are advised to adopt a cautious approach in the upcoming sessions as political temperature is expected to remain elevated,” it added.

As a result, the KSE-100 index settled at 41,737.62 points, up 23.32 points or 0.06 per cent from the preceding session.

The overall trading volume increased 1.3pc to 146.7 million shares. The traded value went up 4.2pc to $17.4m on a day-on-day basis.

Stocks contributing significantly to the traded volume included TPL Properties Ltd (15.7m shares), Unity Foods Ltd (8.2m shares), Dewan Farooque Motors Ltd (7.9m shares), WorldCall Telecom Ltd (7.1m shares) and Fauji Cement Company Ltd (5.8m shares).

Sectors that contributed to the index performance were technology and communication (72.3 points), exploration and production (40 points), miscellaneous (39.7 points), textile composite (7.2 points) and vanaspati and allied industries (5.1 points).

Companies registering the biggest increase in their share prices in absolute terms were Bhanero Textile Mills Ltd (Rs74.10), Pakistan Services Ltd (Rs67.24), Sanofi-Aventis Pakistan Ltd (Rs53.90), Sapphire Fibres Ltd (Rs26.30) and Mehmood Textile Mills Ltd (Rs19.95).

Companies that recorded the biggest declines in their share prices in absolute terms were Rafhan Maize Products Company Ltd (Rs240.01), Nestle Pakistan Ltd (Rs149.99), Premium Textile Mills Ltd (Rs52.42), Reliance Cotton Spinning Mills Ltd (Rs42.15) and JDW Sugar Mills Ltd (Rs28.95).

Foreign investors were net sellers as they offloaded shares worth $0.05m.

Published in Dawn, December 15th, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.