KARACHI: The stock market witnessed a bullish trend on Wednesday as the benchmark index traded in the green zone for the most part of the session.

Arif Habib Ltd said the KSE-100 index opened in the positive zone. However, investors opted for profit-taking in the last trading hour amid a build-up in political noise, thus dragging it down to the negative territory.

The trading volume continued to remain decent in main-board stocks while a hefty volume of third-tier shares changed hands.

According to JS Global, the stock market is expected to remain range-bound in coming days. “We recommend investors should stay cautious on the higher side and wait for dips for any fresh buying,” it said.

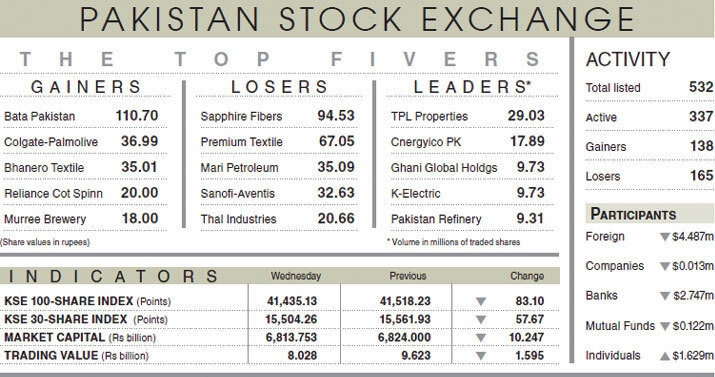

As a result, the KSE-100 index settled at 41,435.13 points, down 83.1 points or 0.2 per cent from the preceding session.

The trading volume decreased 4.4pc to 220.6 million shares while the traded value went down 16.6pc to $34.6m on a day-on-day basis.

Stocks contributing significantly to the traded volume included TPL Properties Ltd (29.3 shares), Cnergyico PK Ltd (17.89m shares), Ghani Global Holdings Ltd (9.73m shares), K-Electric Ltd (9.73m shares) and Pakistan Refinery Ltd (9.31m shares).

Sectors that contributed to the index performance were technology (-57.3 points), fertilizer (-30.1 points), exploration and production (-24.6 points), engineering (-7.1 points) and automobile assembling (-7.1 points).

Companies registering the biggest increase in their share prices in absolute terms were Bata Pakistan Ltd (Rs110.70), Colgate-Palmolive Pakistan Ltd (Rs36.99), Bhanero Textile Mills Ltd (Rs35.01), Reliance Cotton Spinning Mills Ltd (Rs20) and Murree Brewery Company Ltd (Rs18).

Shares that declined the most in rupee terms were Sapphire Fibres Ltd (Rs94.53), Premium Textile Mills Ltd (Rs67.05), Mari Petroleum Company Ltd (Rs35.09), Sanofi-Aventis Pakistan Ltd (Rs32.63) and the Thal Industries Corporation Ltd (Rs20.66).

Foreign investors remained net sellers as they offloaded shares worth $4.48m.

Published in Dawn, September 29th, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.