ISLAMABAD: With fuel cost adjustments in power tariff going through the roof, the government is struggling to ensure fuel supplies in the coming summer months amid higher global prices and supply constraints.

Informed sources told Dawn that no fuel supplier was ready to commit liquefied natural gas (LNG) at lesser than $20 per million British thermal units (mmBtu) while furnace oil prices stay above Rs120,000 a tonne.

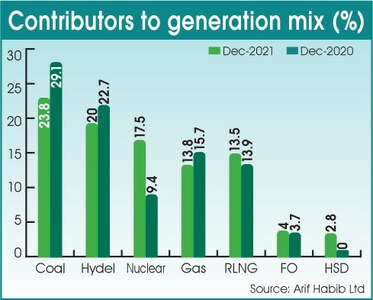

Adding to the challenge is the planned development works at Tarbela Dam, the country’s largest source of hydropower, the cheapest source of power.

Officials said the Ministry of Energy’s power division had told the government that its LNG requirement would start increasing from 380 million cubic feet per day (mmcfd) in March to about 700 mmcfd in April, followed by 850 mmcfd in May and touch 880 mmcfd in June.

That simply means either the government would have to provide the entire LNG supply to the power system that would stifle other economic sectors, including export earners, or the power network would bank on diesel and furnace oil as much as LNG is allowed in the industrial sector.

The fuel cost of diesel and residual fuel oil (RFO) now stands at about Rs26 and Rs23 per unit, respectively, compared to Rs17 for LNG.

However, gas companies operating under the petroleum division of the same ministry has conveyed that total LNG allocation would stand at around 350 mmcfd in March and go up to 500 mmcfd in April, followed by 625 mmcfd in May and 800 mmcfd in June.

Ironically though, LNG supplies of no more than seven to eight cargoes of about 100 mmcfd are lined up from a single source: Qatar.

Other long-term suppliers like Gunvor and ENI have become habitual defaulters in their supply contracts and have chosen to sell their product at significantly higher rates in the spot market instead of honouring their contracts with a sovereign customer.

ENI confirmed it had suffered disruptions in the LNG supply chain in Pakistan, saying that it originated by a third-party supplier that defaulted in its supply obligations for unspecified reasons. It said it was evaluating all contractual remedies, including legal actions, to preserve its rights.

The spot market remains beyond the reach even though state-run Pakistan LNG Ltd (PLL) is now again seeking tenders from spot cargoes after a gap of a few months.

As such, the gap between demand and supply in the power sector would keep growing from 30 mmcfd in March to 200 mmcfd in April, followed by about 230 mmcfd in May and about 80 mmcfd in June.

The Lahore-based Sui Northern Gas Pipelines Ltd (SNGPL) has also warned that these estimates could go haywire if Karachi-based Sui Southern Gas Company (SSGC) retains more than 50 mmcfd of LNG. Interestingly, last year SSGC’s retention was around 120 mmcfd to 228 mmcfd in March to June.

On top of that, the PLL has reported that regasified liquefied natural gas (RLNG) supplies to K-Electric of about 65 to 135 mmcfd would be carved out of planned LNG regasification rates.

“This will further reduce RLNG supplies to SNGPL and, therefore, any such supplies should be arranged by the PLL through additional ordering, over and above SNGPL’s demand,” the Sui Northern Gas Pipelines Ltd said.

This would mean a cascading increase in requirement for furnace oil arrangements both through imports and increased capacity utilisation of local refineries already struggling with non-payments.

On the other hand, the furnace oil demand would be around 45,060 tonnes in March and would almost double to 89,000 tonnes in April. The furnace oil requirement would jump by more than five times to 238,000 tonnes in May and surge by almost eight times to 342,000 tonnes in June.

The power division has asked the petroleum division “to make necessary arrangements to meet RFO requirements to the power sector” and insisted that “LNG should be made available as per the dispatch merit requirements to enable cheaper power generation”.

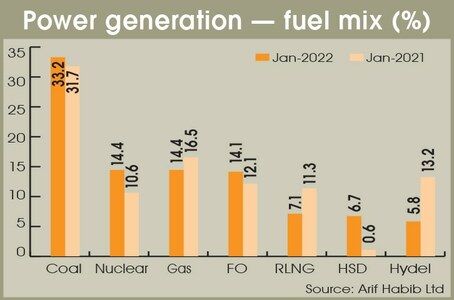

Interestingly, the above estimates are based on a series of assumptions that are subject to substantial variations. This is also apparent from the fact that electricity distribution companies operating under the power division have sought Rs6.11 per unit higher fuel cost adjustment (FCA) for electricity consumed in January — more than 100pc higher than the reference fuel-based tariff estimated and approved by the authorities at the power division and power regulator Nepra.

This happens at a time the gas companies have been allowed 12pc to 18pc losses in RLNG tariff instead of about 3.6pc until November 2021. The increase in resultant RLNG rate would stand automatically shifted to power consumers through monthly FCAs.

The National Transmission and Despatch Company (NTDC) of the power division while placing firm LNG and RFO orders have claimed the estimates were based on hydropower and variable renewable energy generation capability as per historical average.

In the same breath, it adds that the delay in the scheduled outage of Tarbela’s third and fourth tunnels and its effect on reservoir level in subsequent months had also been considered while calculating the fuel requirement.

“These are tentative average figures. Variation in consumption may be observed, as actual system dispatch will depend on plant availability, system demand, merit order and availability of the network,” it adds.

The estimates also consider the availability of Kanupp-III plant of about 1,100 megawatts and Lucky Power of about 660MW as per their expected operationalisation dates. A nuclear plant of Kanupp was reported to be on forced outage, which will impact the scheduled outage of the plant that was previously allowed on April 12, 2022.

It has become increasingly common that reference fuel costs approved by the government and the regulator turn out to be highly unrealistic, putting a question mark on their economic and financial analytical skills.

In recent months, the actual fuel costs have surpassed reference rates by a wide margin that went beyond 100 to 116pc. This results in sudden price shocks to consumers on account of monthly fuel adjustments on top of repeatedly increasing base power tariffs, apparently at the behest of foreign lenders.

This also comes at a time the government wants consumers to utilise more electricity to reduce the impact of capacity charges.

The NTDC said the latest merit order was considered for preparation of fuel requirements and any change in merit order could reflect in overall and individual plant wise consumption of furnace oil and diesel in real time.

Moreover, fuel requirements are also prepared, keeping in mind the contingency reserve requirement of the power system.

The power division has said that LNG, if made available to the power sector in addition to its above-mentioned allocations, will be utilised according to the merit order as and when allocated. “Any variation in RLNG allocation to the power sector from already committed firm allocation will affect consumption of RFO,” the NTDC said.

It demanded that apart from these requirements of fuel oil at various power stations, the fuel stock already consumed must be replenished by building oil stocks at all thermal power plants in accordance with their respective power purchase agreements (PPAs) so that system requirements could be met and any power shortfall due to fuel shortage could be avoided.

The sources, however, said most of the power plants had limited fuel stocks and their managements were unwilling to fill their storages to mandatory 30-day coverage because of huge payables due from the public sector.

Published in Dawn, February 21st, 2022