KARACHI: With the ongoing FATF plenary meeting and the roll-over week, investors thought it prudent to book profit at current levels. It sent the KSE-100 index down for the second day.

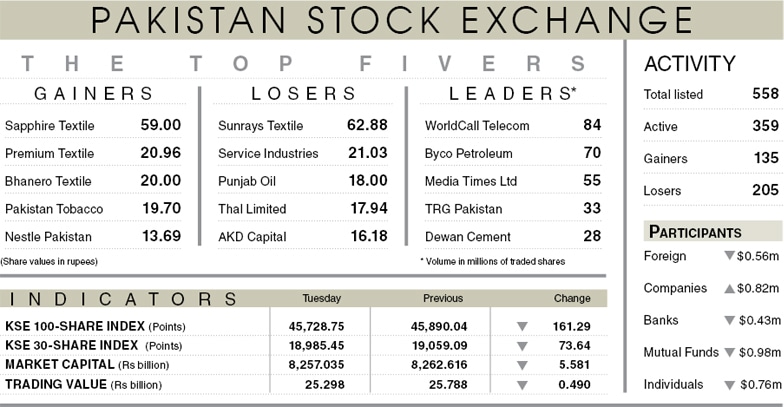

After oscillating between the intraday high and low by 194 and 227 points, the index settled lower by 161 points, or 0.35pc at 45,728.75.

Trade remained choppy as investors were torn between the greed to buy in the results reporting season and the fear of an unexpected market plunge on the major event of ongoing four-day FATF plenary meeting which started on Monday.

Investors were spooked as an Indian magazine drummed up the issue and suggested that Pakistan would remain on the grey list till the next plenary meeting to be held in July. Other than that the roll-over week cast its unsavoury spell as weak investors rushed to cover positions.

Figures released by the National Clearing Company of Pakistan Ltd showed major selling of stocks valued at $1.95m by brokers proprietary trading. Insurance companies wiped out the liquidity with fresh buying of shares valued at $4.11m. Foreigners sold half-a-million worth equity.

Although some noise was audible on the political scene, no one thought it would make a major impact until at least the Senate elections on March 3. Pakistan’s current account deficit declined by 65pc month-on-month to $229m in January.

On the global scene, oil prices were up 1.7pc on production constraints due to the winter storm in Texas, USA. It put life into the Exploration & Production scrips which made a short rally before withdrawing on growing selling pressure in the market.

Banks, cement, O&GMCs continued to go downhill. Technology stocks saw reversal after hitting session’s high and closed in red. The major scrips that pushed the index down included TRG (89 points), HBL (43 points), MEBL (17 points), PSO (14 points), and Thal Ltd (13 points).

The traded volume slid 0.5pc over the previous session to 718.2m shares while the value declined 2pc to Rs25.3bn.

Published in Dawn, February 24th, 2021

Dear visitor, the comments section is undergoing an overhaul and will return soon.