ISLAMABAD: In the wake of the first meeting with a delegation of the IPPs to discuss payment of circular debt and implementation of memorandums of understanding (MoUs) signed with the power producers, the government has decided to pay Rs135 billion out of Rs450bn circular debt and settle the remaining amount by the end of the current calendar year.

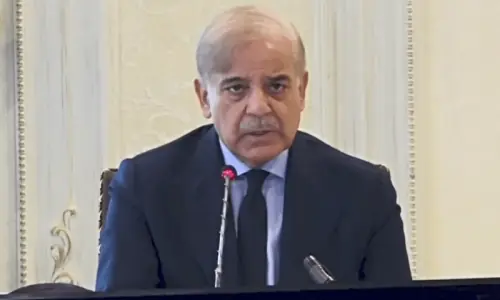

Sources in the finance ministry said that a delegation of Independent Power Producers’ (IPP) managements held a meeting with Finance Minister Dr Abdul Hafeez Shaikh a day earlier to discuss the repayment plan for overdue circular debt receivables under the recently signed MoUs.

This was the first meeting in which a workable plan was agreed by both sides. The IPP delegation termed the plan “acceptable” and the government officials said that it was affordable for the government.

It has been agreed that of the total outstanding receivables amounting to Rs450bn, the government will pay 30 per cent now and the remaining payment will take place in equal tranches by June and December.

Sources also said that the next round of meetings between the committee for implementation of MOUs signed with IPPs would take place on Jan 4 and 5 in Islamabad.

The committee is led by Dr Shaikh and comprises of Special Assistant to the Prime Minister on Power Tabish Gauhar, Chairman of Federal Land Commission of Pakistan Babar Yaqoob Fateh Mohammad, who had earlier led the negotiations with IPPs, secretaries of power and finance and the chief executive of Central Power Purchasing Agency.

The meetings will finalise the amendments to the power purchase agreements based on the MoUs signed in Aug 2012.

“The government is expected to renew the agreements with the IPPs, and it is expected to save more than Rs850 billion in the next 10 years,” an official of the finance ministry added, adding that the complete plan was likely to be finalised in several more meetings between the government and the IPPs scheduled in Jan.

On the other hand, the scheduled payment plan will help the IPPs improve their liquidity position and expand the businesses, mainly in the coming energy sources like renewables or coal-based plants in Tharparkar.

The official added that there were limitations for the furnace oil-based power plants, whereas there were several upcoming options in the power sector.

Published in Dawn, January 2nd, 2021