KARACHI: The stock market witnessed all-round selling on first day of the trading week when the index after an initial gain of 46 points, tanked to intraday low by 383 points as profit-taking kicked in.

The closing was seen in deep red with the index dragged down by 331 points (0.78 per cent) to close at 42,174.

Investors’ interest in equities was at low ebb in the absence of positive triggers. On the contrary, heightened noise of the opposition unnerved traders who feared another bout of heated atmosphere on the political front.

But the major factor that went to dampen investor sentiments was the first day of the futures rollover week which led to heavy selling by weak holders. Although the SBP was scheduled to announce the monetary policy in the evening, it was thought to be a non-event as the market expected status quo in the policy interest rate.

To further darken the investors’ mood, the Pakistan Bureau of Statistics announced that exports declined by 4.27pc in 2MFY21 and textile exports fell by 1pc, which left participants wondering over the strategy ahead.

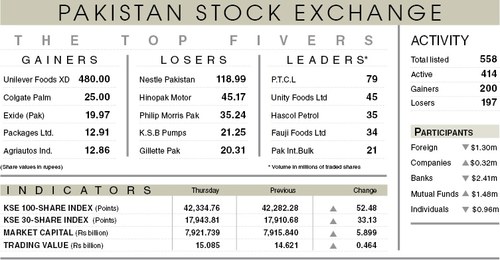

Foreign selling was worth $0.60 million. Among local participants, banks and brokers proprietary trading showed major sell-off, while companies, mutual funds and individuals kept picking up shares at dips.

The volume witnessed a decline of 16pc to 433m, shares from 516m that changed hands last Friday. Traded value also fell to Rs11.3 billion, from Rs13.6bn. Major contribution to total market turnover came from Aisha Steel, Unity Foods and Fauji Foods churning 143m shares out of the total 434m.

Shares of banks, fertilisers and exploration and production were major laggards where Habib Bank, down 0.9pc, MCB 0.5pc, Engro Corporation 0.9pc, Fauji Fertiliser 1.2pc, Oil and Gas Development Company 1.6pc, Pakistan Petroleum 0.9pc and Pakistan Oilfields 0.3pc weighed down on the index.

Published in Dawn, September 22nd, 2020

Dear visitor, the comments section is undergoing an overhaul and will return soon.