KARACHI: Bears growled on the floor of the stock market on Thursday knocking off the KSE-100 index by 325.02 points (0.95 per cent) which settled below the 34,000 level at 33,709.63.

All-index heavy sectors which included exploration and production; banking and fertilisers suffered heavy falls as the investors’ interest waned on several pressing issues.

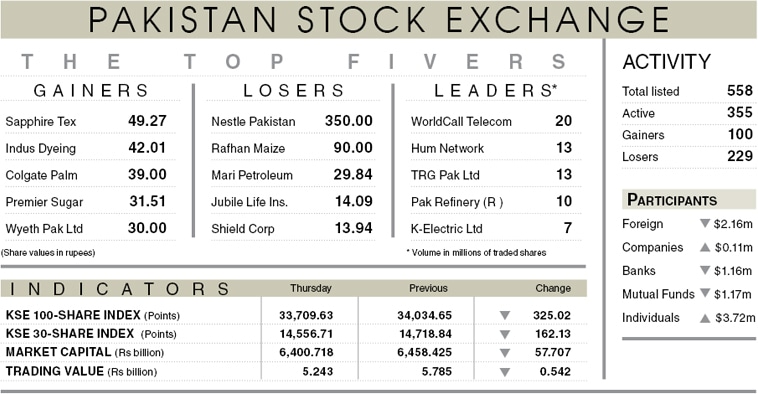

On the economic front, the International Monetary Fund reducing Pakistan’s FY21 GDP growth outlook a day ago to 1pc from 2pc earlier, underscoring the need to focus on growth dented investor sentiments. Foreigners were sellers of equity worth $2.16 million. Individuals and insurance companies mopped up the liquidity. The rollover week was the major hurdle in building fresh positions.

The index opened in the red and remained negative for almost most of the trading time. In the exploration and production, Pakistan Petroleum; Oil and Gas Development Company and Pakistan Oilfields for the second day finished in the red. This was due to international crude prices coming under pressure over the possibility of supply glut as the demand was feared to stagger because of slowdown in opening up of economies over increasing new cases of Covid-19.

Cement stocks showed fairly good price performance on the back of anticipated increase in despatches in the ongoing month.

The volume fell 15pc to 168.4 million shares while traded value also declined 9pc to reach $31.5m. Sectors contributing to the performance included E&P, decreasing by 86 points, banks 55 points, power 39 points, food 39 points and fertiliser 30 points.

Scrips that dragged down the index were Engro Corporation, down 0.5pc, Fauji Fertiliser 1.5pc, Habib Bank 0.8pc, OGDC 2.1pc, Hub Power 2.4pc, MCB 2.1pc, Pakistan Petroleum 2.1pc and Lucky Cement 0.8pc.

After the close of the session, the State Bank of Pakistan conducted an unscheduled meeting and ann—ounced further monetary policy rate cut by 100 basis points to 7pc. Traders suspected that those in the knowledge of what was to come jettisoned bank shares during the day which saw sharp fall in prices of major scrips in the sectors, Habib, MCB and Alfalah.

Published in Dawn, June 26th, 2020

Dear visitor, the comments section is undergoing an overhaul and will return soon.