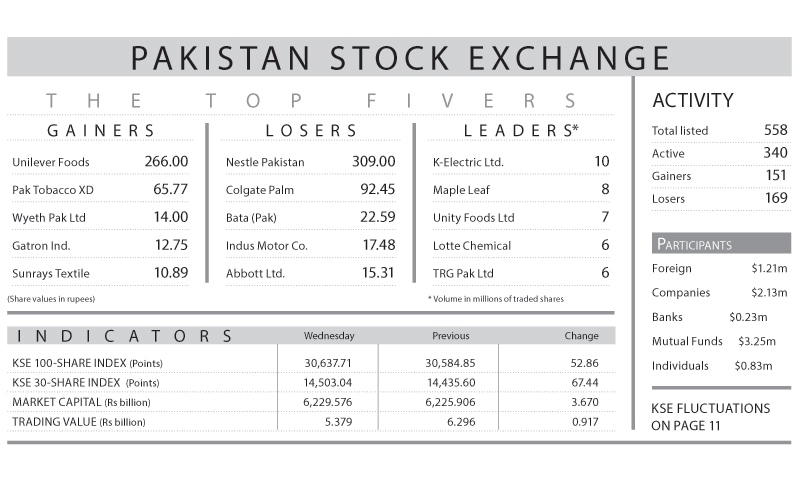

KARACHI: Stocks managed to make minor gains for the second day as the KSE-100 index clawed up by 53 points (0.17 per cent) and closed at 30,638.

The market opened positively amid value buying by “companies” which pushed it through to intra-day high by 528 points. But with individuals opting to remain out on the side-lines, the index could not absorb heavy selling by mutual funds and retraced all the gains to dip in the red by 33 points.

In the final hour, the index managed to push its head above water. During the day, the market saw short coverings by short-sellers in the futures roll-over week.

The negative news flow of uncertainty over the Financial Action Task Force decision, higher-ever budget deficit and lower-than-anticipated revenue collection drowned the positive expectations of enhanced market liquidity due to proposed new measures by the apex regulator.

The rally in the early hours was led by the refinery, steel, autos, fertiliser and cement sectors as blue chips in refinery and steel hit their upper limits. Exploration and production (E&P) sector contributed 35 points to the index on the back of rising global crude oil prices.

Volumes increased 24.4pc over the previous day to 149.0 million shares while traded value was up 1.5pc to reach $34.2m. Stocks that contributed significantly to the turnover were K-Electric (KEL), Maple Leaf Cement Factory, Unity Foods Ltd, Lotte Chemical and TRG Pakistan, which formed 25pc of total volumes.

Mixed sentiments were seen in the banking sector where Habib Bank Ltd closed negative while MCB Bank Ltd and United Bank Ltd (UBL) closed with gains. Engro Corporation (ENGRO) was the major gainer in the fertiliser sector while Pakistan Petroleum Ltd (PPL) and Pakistan Oilfields Ltd (POL) turned the E&P sector stronger.

Scrips that added points to the index included ENGRO up 3.21pc, UBL 2.24pc, Pakistan Tobacco 4.75pc, POL 2.55pc and PPL 1.87pc while Dawood Hercules was down 2.60pc, Nestle 5pc, KEL 6.48pc, Colgate-Palmolive 5pc and Habib Metropolitan Bank 2.77pc were the main laggards.

Published in Dawn, August 29th, 2019

Dear visitor, the comments section is undergoing an overhaul and will return soon.