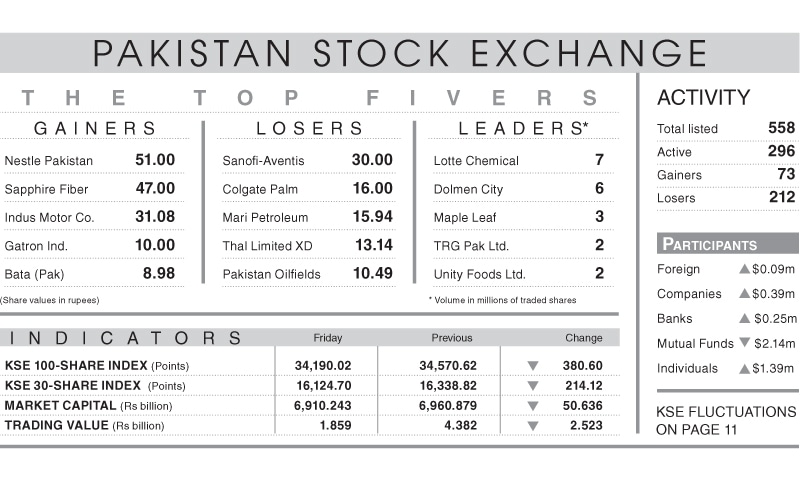

KARACHI: Market remained on the slippery slope for the second day with the KSE-100 index tumbling 380.60 points (1.10 per cent) and settled for the week-end at 34,190.02.

As the euphoria over the approval of the $6 billion loan by the International Monetary Fund (IMF) Executive Board fizzled out, there was no positive trigger, while the investors were perturbed by the bleak outlook on the economic front and an unsettled political environment.

All of that dragged the Index down to extend the loss suffered the earlier day.

“Market participants continue to sell the rally seen during the days leading up to the much-awaited IMF decision” commented a senior analyst. With the week-end ahead, investors decided to trim their portfolio and book profit as uncertainty was again beginning to take hold of the market.

The index opened on a negative note on Friday with minus 45 points on the board.

It continued to descent to touch intra-day lows by 508 points on extremely thin traded value of Rs1.86bn.

Sector-wise, fertiliser, oil and gas marketing companies, banks and exploration and production contributed to the day’s losses.

Cement stocks once again tumbled as the strike by cement distributers continues.

D.G. Khan Cement closed lower 3.62pc and Lucky Cement declined 1.55pc and Maple Leaf Cement Factory (MLCF) came down by 2.5pc.

Among banks, Habib Bank Ltd (HBL) down 1.7pc, Bank al Habib Ltd 0.9pc, United Bank Ltd 0.3pc, MCB Bank Ltd (MCB) 1.8pc and Bank Al Falah Ltd 1.1pc were the major laggards.

Traded volumes declined to 51 million shares from 112m shares (down 54pc day-on-day). Traded value also plunged by 58pc to reach $11.8m as against $28m the earlier day.

Stocks that contributed significantly to the volumes include Lotte Chemical (LOTCHEM), Dolmen City REIT, MLCF, TRG Pakistan and Unity Foods, which formed 40pc of total volumes.

Stocks that contributed most to the Index slide included HBL down 32 points, Pakistan Oilfields Ltd 29 points, MCB 28 points, Engro Corporation Ltd 22points and Fauji Fertiliser Company 20 points.

On the other hand, scrips that added to the Index were INDU nine points, Nestle five points, Meezan Bank Ltd five points, National Foods four points and LOTCHEM three points.

Published in Dawn, July 6th, 2019