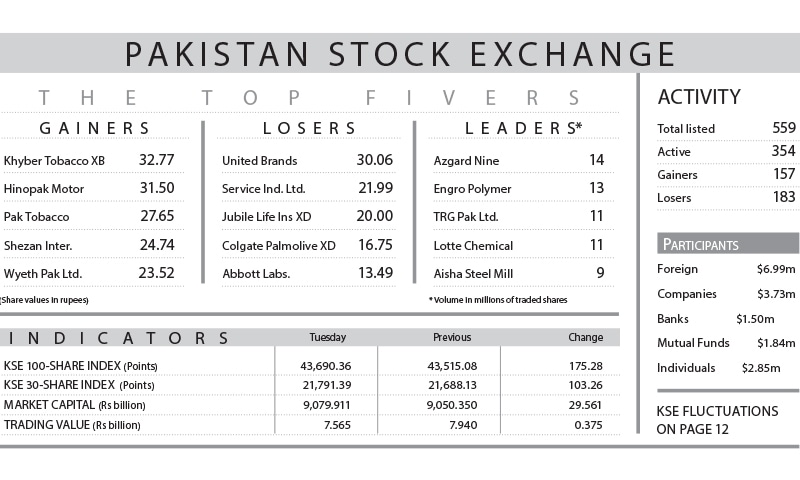

KARACHI: Equities at the Pakistan Stock Exchange (PSX) ended on a positive note on Tuesday with the KSE-100 index recovering 175 points (0.40 per cent) to close at 43,690.

The gainers were led in large part by the heavyweight banking stocks on the positive news flow of a possible increase in banks’ pension liabilities to a minimum of Rs8,000 per month on the apex court’s order applying to future pension payments non-retrospectively.

It provided a huge relief to individual and institutional investors who picked up banking shares.

Regardless of the rebound in global and regional markets, trading at the PSX started on a dull note as investors were jittery over the heavy foreign selling a day earlier. Last half of the trade again saw selling pressure in cement, auto and steel sectors.

The trading volume and value during the trading session shrank by 5pc over the earlier day.

Sector wise, commercial banks added 167 points to the index, followed by fertiliser at 23 points and exploration and production 17 points. On the contrary, cement sector scrapped 21 points.

Heavyweight Lucky Cement and DG Khan Cement also saw profit taking in the cement sector. As oil prices spiked by 0.8pc during the day, E&P stocks posted recovery with Pakistan Petroleum up 0.73pc and Oil and Gas Development Company 0.04pc.

Major gainers on Tuesday were Habib Bank, up 3.3pc, United Bank 2.3pc, Engro Corporation 1.1pc, Pakistan International Bulk Terminal 5.7pc and Bank Alfalah 2.7pc contributing 186 points to the index whereas Lucky Cement, down 1.1pc, Dawood Hercules 1.3pc, DG Khan Cement 2.2pc, Searle Company 2pc and Hascol Petroleum 2.1pc withheld 62 points from the index.

Meanwhile, in its quarterly review overnight, MSCI announced no change for Pakistan constituents that was largely anticipated by the market.

Published in Dawn, February 14th, 2018

Dear visitor, the comments section is undergoing an overhaul and will return soon.