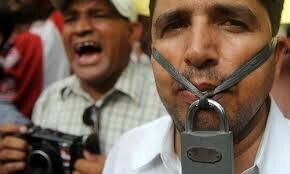

JAKARTA: The rich and famous in Asia were not spared in the latest leak of confidential financial data, which shows how Bermuda law firm Appleby allegedly helped the wealthy around the world to set up offshore trusts in tax havens to hide their assets from the taxman at home.

The information was made public by the International Consortium of Investigative Journalists (ICIJ) at the weekend, and the authorities in at least one jurisdiction in the region — Indonesia — are already looking at the names which surfaced in what has been dubbed the “Paradise Papers”. They include Indonesia’s former army general and opposition coalition leader Prabowo Subianto, as well as the scions of former president Suharto, Tommy and Mamiek.

“We will try to obtain more comprehensive and detailed data as part of efforts to ensure taxpayer compliance,” said Mr Hestu Yoga Saksama, spokesman for the Directorate General of Taxation.

Mr Dian Ediana Eae, who is deputy chief of Indonesia’s anti-money laundering agency, the Financial Transaction Report and Analysis Centre, also confirmed that the agency was looking into the accounts and fund movements of the people identified in the leak.

Other familiar names in politics, business and even entertainment from Hong Kong, India, Japan and Malaysia were also flagged by the ICIJ, which has promised to release more details of illicit transactions, involving cross-border transfers of trillions of dollars, in the weeks ahead.

There are 714 names of Indian businessmen, lawmakers and Bollywood stars and at least one federal minister, according to The Indian Express, which was one of 96 organisations that were part of the ICIJ investigative project.

These individuals include Indian superstar Amitabh Bachchan, Minister of State for Civil Aviation Jayant Sinha and businessman Vijay Mallya who is wanted in India for financial irregularities and is currently in Britain.

In Japan, former Japanese prime minister Yukio Hatoyama and Masamitsu Naito, who served as state minister for internal affairs and communications, were among a handful of former Diet members said to have ties to tax havens in Bermuda and the Cayman Islands.

Responding to questions from The Asahi Shimbun, Mr Naito said: “I was introduced to what was described as a valuable foreign investment opportunity. I did not know it was based in a tax haven.”

Information on Mr Tommy Suharto and his sister, Mamiek, indicated that the companies they were linked to in Bermuda were closed after a few years.

Similarly, Mr Prabowo’s Nusantara Energy Resources, which was established on the British island territory in 2001, was closed by 2004, according to Appleby’s records.

Fadli Zon, who is deputy chairman of Prabowo’s Gerindra Party, denied that the firm was set up to avoid taxes and said that it had not been active since it was founded.

“This is a one-dollar company,” he told Tempo magazine.

The leak of 1.4TB of data from two offshore service providers and 19 tax havens’ company registries makes the Paradise Papers the second-largest data dump after the Panama Papers last year, which involved 2.6TB of data.

The cache of leaked information also was reported to contain confidential client e-mails, including one dated Aug 10, 2015, from Malaysian businessman Low Taek Jho’s lawyer, Demelza Hassani, to Appleby, inquiring about extradition laws in the Caymans and British Virgin Islands.

Mr Low has been linked to alleged efforts to siphon billions of dollars from Malaysian state investor 1Malaysia Development Berhad, better known as 1MDB.

While offshore entities are typically legal, the secrecy they provide attracts money launderers, drug traffickers, kleptocrats and others, said the ICIJ in a report on Sunday. “Offshore companies, often ‘shells’ with no employees or office space, are also used in complex tax-avoidance structures that drain billions from national treasuries,” it said.

The consortium, however, maintained on its website that there are legitimate uses for offshore companies and trusts, adding: “We do not intend to suggest or imply that any people, companies or other entities included in the ICIJ Offshore Leaks Database have broken the law or otherwise acted improperly.”

The Straits Times

Published in Dawn, November 8th, 2017