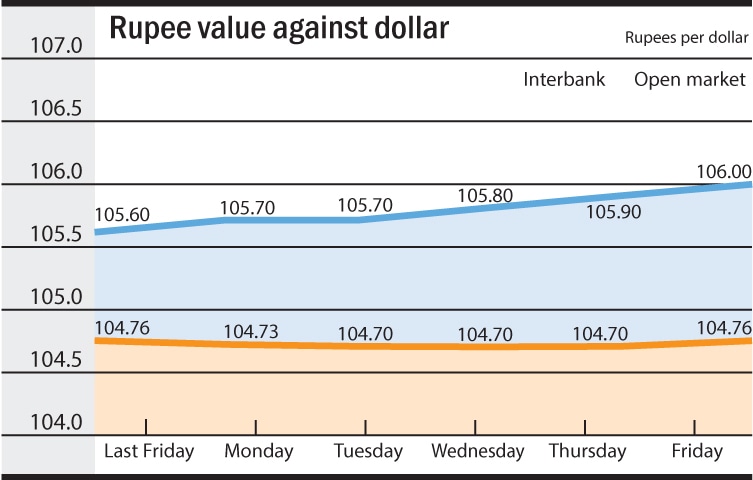

In the local market, the rupee crossed the Rs106 barrier against the dollar amid mixed sentiments last week.

On the global front, after an initial wobble, the American currency rebounded sharply to its highest level in two weeks and continued its upward surge as aftermath of the US presidential election jitters following Donald Trump surprise victory.

On the interbank market last week, the rupee firmness against the dollar prevailed for the second consecutive week amid persistent low dollar demand and sufficient supply.

Against the euro, the rupee received a significant boost last week

Extending weekend firmness, the rupee picked up three-paisa on the buying counter and two-paisa on the selling counter in the first trading session when the dollar was seen changing hands at Rs104.75 and Rs104.75 against the last closing level of Rs104.76 and Rs104.77.

In the last trading session, however, the dollar managed to reverse the trend against the rupee in the interbank dealings on pickup in demand and posted gains of six-paisa on the buying counter and another five-paisa on the selling counter. At the close of the week, the rupee slipped to its lowest level in the week at Rs104.76 and Rs104.77, unchanged over the previous week’s close. In the first two week of November, however, the rupee gained five-paisa against the dollar.

For the open market, in the last trading session, the rupee continued to depreciate against the dollar for the thirdconsecutive session. the rupee to dollar exchange rate tumbled to hit a three-and-a half month low to close the week at Rs106.00 and Rs106.20 in the domestic market after the greenback in overseas trade surged to its highest in nine months against a basket of major currencies and was seen on track for its best week in a year backed by a stronger-than-expected US consumer sentiment report.

During the week, the dollar gained 30paisa against the rupee in the open market on week on week basis.

Against euro, the rupee received a significant boost last week, trading between the high of Rs115.10/Rs116.60 and low of Rs117/Rs118.50.

The week commenced on a positive note after snapping previous week’s losing streak.

In the fourth trading session, the rupee rebounded sharply against the euro as the rupee to euro exchange rate rallied by Rs1.75, the biggest single-day gain before striking its highest level at Rs115.25 and Rs116.75 in three weeks.

In the fifth trading session, the rupee further gained 15paisa, sending the euro to almost a three-week low at Rs115.10 and Rs116.60 at the close of the week.

During the week in review, the rupee picked up Rs2.90 against the euro in four sessions while it shed 50paisa in one session.

On week over week basis, the rupee posted fresh gain of Rs2.40 against the euro, striking its highest level in November so far.

Published in Dawn, Business & Finance weekly, November 14th, 2016