LONDON: A forensic detective might be able to find traces of the financial markets’ geopolitical concern. Mentions of Ukraine and Islamic State appear in the commentaries on down days, or when the prices of safe assets climb. But equities, considered risky, are up — and the oil price is weak. It looks like investors have decided not to worry about the world.

The developments in both Russia and the Middle East have followed a trajectory that only extreme pessimists would have anticipated a year ago. But the markets have fixated on the response of central banks to the varying pace of recoveries in the Western world.

Investors’ insouciance is defensible. From their viewpoint, the Ukrainian economy is too small to matter. Sanctions on and from Russia, which has a GDP about the size of Italy’s, will slow the euro zone down, but the pain will prompt countermeasures from governments and central banks. As for the Middle East, oil is paramount for investors, and the price of crude speaks louder than hypothetical disaster scenarios.

However, the financial peace looks precarious.

The New Russia of Vladimir Putin, the country’s autocratic president, is trampling on the conventions of modern peaceful prosperity. Domestic economic and political discontent could eventually undermine his regime, but a desperate Putin could be more dangerous. Now that the post-Soviet vision of an ever more unified Europe has come to a definitive end, tension and provocations are likely to be enduring economic drags.

The Islamic State is well-armed, aggressive, reasonably well organised, popular and dedicated to reshaping the entire Middle East. The three largest oil producers in the region — Iran, Iraq and Saudi Arabia — are among its many ideological enemies. As long as the United States and the new entity’s regional foes dither, an attack leading to a major disruption of oil production in the region cannot be ruled out.

A year ago, the greatest geopolitical threat to the financial good times was thought to come from the rise of China. That may be true for the next decade, but for now investors should watch out for damage from festering old problems.

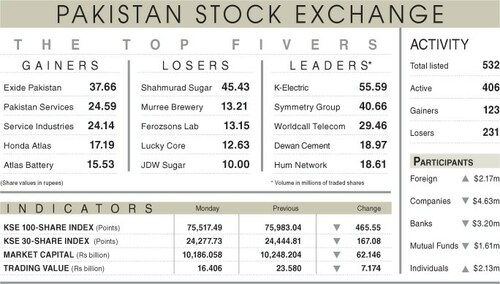

The price of a barrel of Brent crude oil has fallen from $116 to $103 since June 19. In that period, the MSCI World equity index rose 1 per cent, and the US S&P 500 equity index rose by 3pc.

Published in Dawn, September 2nd , 2014

Dear visitor, the comments section is undergoing an overhaul and will return soon.