The Great Recession, which officially ended by the middle of 2009, caused large-scale suffering in the US and Europe, unheard of since the Great Depression. It led to large-scale unemployment and homelessness with millions living without adequate health cover. Youth unemployment level reached an all-time high in the depressed economies of Europe, for instance, almost 43 per cent in Spain. Within a year and a half, the US economy fell by five per cent. The absence of quick recovery is caused by lack of aggregate demand from the private sector, especially investments, and is negatively influenced by austerity measures brought in by the government. This can be gauged after the state and local governments laid off 300,000 school teachers and postponed or cancelled investments in transportation, water and other infrastructure projects.

Krugman zealously advocates spending, the kind seen during the buildup of the Second World War, and is not impressed by the stimulus package implemented by the Obama administration.

According to Krugman, the reasons for the recession go as far back as the 1980s, when the advanced world was ruled by a fiscally conservative elite and ‘de-regulation’ was the mantra. The premise behind the regulation of industries and services was enhanced competition, thus increasing efficiency of services.

Due to the dogmatic belief of the conservatives in deregulation, finance and banking sectors were also deregulated and the regulations put in place following the Great Depression were lifted.

This was done in an environment when the incomes of the top one per cent (the term made popular by the Occupy Wall Street movement) soared exponentially. They saw an income rise of 277.5 per cent between 1979 and 2007 compared to 18 per cent for the bottom quintile.

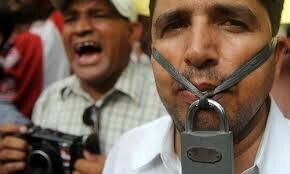

The wealthy treated themselves very well during the period with massive reduction in tax rates, shortchanging of aid to the poor and the decline of public education. This left the poor and the middle classes at the mercy of financial institutions to meet some of their basic necessities. The workers’ resistance to deregulation was hampered by reduced membership in unions, thus reducing their bargaining power.

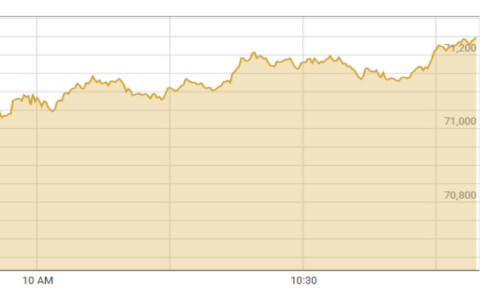

The availability of credit coupled with the pauperisation of the bottom 99 per cent and the indulgence of banks into speculative business in a deregulated environment increased household debt to unsustainable levels and the situation was ripe for a catastrophe. The financial crisis of 2007 resulted in a sudden drought in consumer spending and private investment; the number of housing startups dropped from 1.8 million in 2006 to less than 600,000 in 2010 and the purchase of automobiles went from 16.5 million down to 11.6 million. The normal response to a recession is to reduce interest rates to encourage consumer spending and investment but the situation was different this time with interest rates reaching nearly zero by late 2008. The ferocity of the recession required an urgent and radical response to spurt spending, something on the scale of Roosevelt’s Works Progress Administration which employed 10 per cent of the American workforce at its peak.

The Fed tried to intervene by printing money but the response was inadequate considering the scale of recession. Krugman warns of the long-term harmful effects of the long recession, which will permanently reduce the production capability of the economy, while the laying off of school teachers will impair the capabilities of the future generation.

There is enough evidence that the only way to move out of recession is to increase spending whereas fiscal hawks are calling for governments to reign in social-sector spending to balance budgets. Krugman is asking governments in both America and Europe to moderately increase inflation for the next decade to reduce high debt levels.

Presently, Krugman is more worried about the deflationary pressure of the recession rather than the inflationary threat that is perceived by many on the right side of the political spectrum. He also cites the classic example of deflation in Japan in the wake of the Japanese financial crisis of the 1990s.

Krugman has urged public intellectuals, economists as well as the Obama administration to stand up against the fiscal hawks to end the economic crisis and he ends this book on a hopeful note: “The fact is we have both the knowledge and the tools to get out of this depression. Indeed, by applying time-honoured economic principles whose validity has only been reinforced by recent events, we could be back to more or less full employment very fast, probably in less than two years.”

End This Depression Now!

(Economics)

By Paul Krugman

W. W. Norton & Company, NY

ISBN 978-0393345087

255pp.

Dear visitor, the comments section is undergoing an overhaul and will return soon.