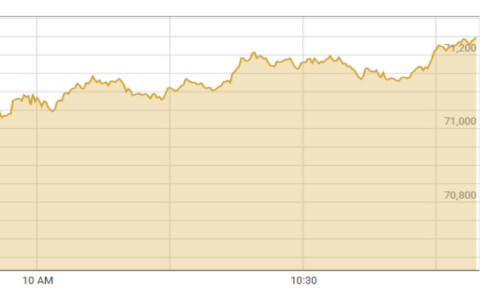

MUMBAI: India's central bank likely intervened in the foreign exchange markets on Wednesday to prop up the currency after the rupee slid to a near four-month-low against the dollar, traders said.

The unit fell below the key 53 rupees to the dollar level, hitting an intraday low of 53.01—a level last seen in January—and then recovered slightly to 52.87 on the suspected intervention.

The partially convertible currency has been hurt by global uncertainty, weak domestic economic data, weakening overseas fund inflows and pressure from oil importers who have to exchange rupees for dollars when they purchase crude.

Energy-hungry India imports around four-fifths of its crude oil needs to fuel its economy.

“There was a modest (RBI) intervention, at 53 rupee levels,” a trader said, declining to be named. He said that some state-run banks also sold dollars, possibly on behalf of the RBI.

The RBI intervenes only to prevent sharp volatility and has a policy of not commenting on rupee movements or confirming forex market interventions.

But traders estimated this was the ninth such central bank action in 2012 so far.

Abhishek Goenka, chief executive of India Forex, a consultancy firm, said: “Internationally, the dollar is getting into a recovery phase.”

And Naveen Mathur, associate director of commodities and currencies at Mumbai's Angel Broking, said: “Weak economic conditions are not allowing for the rupee to appreciate.”

Last month the bank cut interest rates by a bigger-than-expected 50 basis points -- its first reduction in three years -- in an effort to spur growth.

But concerns about India's widening trade gap, which last year hit a record $184.9 billion, and its fiscal deficit offset any investor hopes that the rate cut could spur flagging economic growth, traders said.

The rupee—Asia's worst performing currency in 2011—hit a record-low of 54.30 against the dollar in mid-December.

The Indian currency then recovered to 48.67 rupees to the dollar in February, led by strong foreign fund buying of Indian equities and debt, but then slid again as share prices softened.

Dear visitor, the comments section is undergoing an overhaul and will return soon.