THE election of Donald Trump to be the president of the United States once again marks a pivotal moment in world history; one that many believe may well redefine the global order. Renowned historian Professor Yuval Noah Harari had rema-rked ahead of the elections that a Trump win “will be like a death blow to what remains of the global world order”. Now that Trump has won, the new American leadership may reshape not just domestic policies, but also the country’s global alliances and economic strategies.

Many commentators have analysed Trump’s victory as a reaction to economic issues that were overlooked by the Democrats, particularly those affecting working-class Americans. The Democratic Party’s failure to address the harsh reality of inflation and rising costs left millions of Americans feeling neglected, and this dissatisfaction ultimately drove them towards Trump, it is being argued.

As a result, the incoming administration is set to inherit an economy marked by high levels of national debt and wavering economic and manufacturing activity. These are challenging times, as noted by Federal Reserve Chairman Jerome Powell, who recently described the US debt as being on an “unsustainable path”, with interest on that debt alone nearing one trillion dollars.

However, when it comes to the Wall Street, the story appears paradoxical. The Standard and Poor’s 500 (S&P-500) index is at a record high, and the Case-Shiller Home Price Index has reached new peaks, indicating that financial assets are undergoing lofty valuations. These highs coexist with economic vulne-rabilities, including rate cuts by the Federal Reserve amid slowing growth and a weakening manufacturing sector.

Trump’s economic team, expected to have Peter Navarro and Robert Lighthizer as the leading lights, is expected to champion new tariffs, fuelling fears of an impending shift towards protectionism. The currency market has already responded, with early signs of a stronger dollar reflecting expectations of an aggressive trade stance. Will the policies of Trump administration ignite economic growth? Well that remains uncertain, and will depend largely on how the transition of power unfolds, and on how the US bond market reacts to the ongoing strains within the financial landscape.

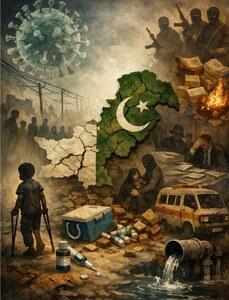

For Pakistan, Trump’s presidency intro-duces both challenges and opportunities. Maintaining positive relations with the US, an economic powerhouse and major trading partner, is essential.

We have seen this recently in the United Kingdom, where the current government is actively seeking to repair ties with the US following controversial remarks earlier passed by some Labour Party members about Trump.

Aligning with global shifts in a way that fosters inclusive economic growth could be key for Pakistan in safeguarding its own stability in these uncertain times.

Adil Hanif Godil

London, UK

Published in Dawn, November 14th, 2024