KARACHI: The stock market turned in a flat performance in a cautiously traded session on Tuesday given persistent political and economic challenges amid a lack of clarity on the future direction of the country in the near term.

Topline Securities said the market began trading on a positive note and the benchmark KSE-100 index hit an intraday high of 777.77 points to 61,237.51. However, it couldn’t sustain the early gains as the lingering political gridlock hampering the formation of the federal government soured the market sentiments.

However, in the pharmaceutical sector, a surge ensued following news of the ministry’s green light for deregulating the prices of non-essential medications. GlaxoSmithKline Pakistan Ltd, The Searle Company Ltd, Citi Pharma Ltd and AGP Ltd all hit their upper circuits.

Ahsan Mehanti of Arif Habib Corporation said investors weighed Fitch’s warnings over upheavals on the IMF programme on political uncertainty and dismal data on the current account deficit at $269m in January.

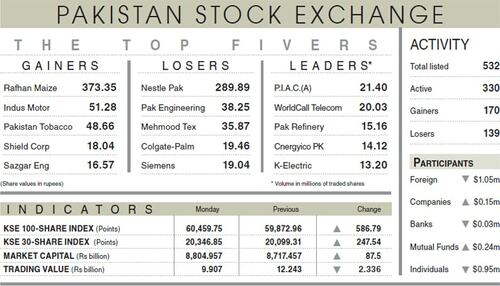

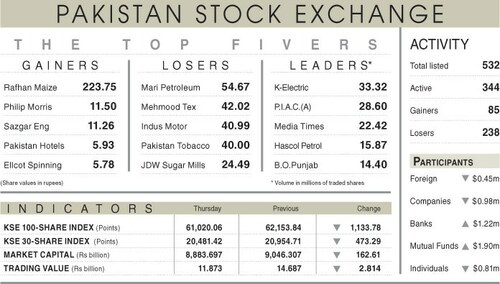

As a result, the KSE-100 index closed flat at 60,464.24 points after inching up 4.5 points or 0.01 per cent from the preceding session.

The overall trading volume surged by 39.20pc to 364.44 million shares. The traded value also soared 10.30pc to Rs10.92bn on a day-on-day basis.

Stocks contributing significantly to the traded volume included Bank of Punjab (117m shares), Pakistan International Airlines Corporation (19.28m shares), K-Electric (13.20m shares), WorldCall Telecom Ltd (16.49m shares) and Pakistan Refinery Ltd (13.78m shares).

Shares registering the biggest increases in their share prices in absolute terms were Pakistan Tobacco Company Ltd (Rs49.16), Ismail Industries (Rs45.00), Highnoon Laboratories (Rs35.25) and Lucky Core Industries (Rs26.97).

Companies registering the biggest decreases in their share prices in absolute terms were Unilever Foods (Rs490.00), Sapphire Textile Ltd (Rs124.00), Pakistan Services Ltd (Rs50.00), Mari Petroleum Ltd (Rs44.66) and Ibrahim Fibres Ltd (Rs34.74).

Foreign investors remained net sellers as they sold out shares worth $0.45m.

Published in Dawn, February 21st, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.