KARACHI: The stock market posted another major decline of 1.5 per cent on Tuesday due to investor concerns over political noise and security unrest in the country.

It was the fourth consecutive drop on the market, and the benchmark KSE-100 index has now lost nearly 3,000 points since last Wednesday.

“Weak economic outlook pending fiscal reforms for loss-making SOEs (state-owned enterprises), power sector circular debt crises and reports of six-month budget deficit soaring to 2.3pc of GDP played a catalyst role in bearish close,” Arif Habib Corporation Ltd analyst Ahsan Mehanti said.

Shares initially showed optimism as the State Bank’s decision to keep the policy rate unchanged at 22 per cent alleviated investor concerns. However, a sudden escalation in political tensions reversed the market’s positive momentum in the second half, and it eventually closed in the red.

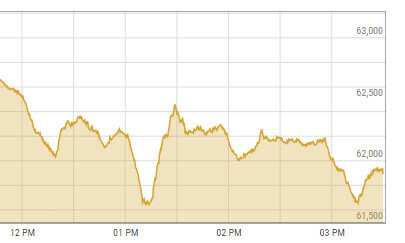

The KSE-100 index oscillated between an intraday high of 63,074.51 points and a low of 61,637.62, finally settling at 61,841.74, or 931.98 points lower than the previous day’s close.

Shahab Farooq, director of research at Next Capital Limited, attributed the bearish momentum to political uncertainty ahead of the Feb 8 general elections. “Geopolitical concerns, along with foreign selling, restricted market performance,” he told Dawn.com, adding that the market was expected to remain volatile in the near term.

Abdul Azeem, head of research at Spectrum Securities Ltd, observed that the index “witnessed a significant contraction” and attributed the decline to political uncertainty and sustained foreign selling.

“The special court’s decision to impose a 10-year sentence on Imran Khan and Shah Mahmood Qureshi, coupled with foreigners selling $17.7 million worth of shares during the last two sessions, eroded investor confidence and led to heightened selling pressure in the market,” he said.

According to Dawn.com, Mr Azeem noted that international oil prices had increased by $0.23 per barrel, reaching $77.02 “amid concerns over falling demand also had a negative impact on the market”.

The overall market volume inched up from 317m million shares in the last session to 436.1m on Tuesday.

The highest volumes were witnessed in K-Electric (KEL -4.12pc), WorldCall Telecom (WTL -1.60pc) and Hascol Petroleum (HASCOL +1.93pc). The scrips had 52.9m, 29.22m and 24.69m shares traded, respectively.

Published in Dawn, January 31st, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.